Beijing to Brussels: Trade diversion concerns unnecessary

An op-ed in Global Times cites Bruegel's study to show that "risk overall seems limited, and deflationary forces from trade diversion to the EU might end up being beneficial."

Today (Thursday, April 24), the Global Times newspaper ran a Chinese-language commentary telling the European Union that the latter doesn’t have to worry about Chinese goods flooding the world’s largest trading bloc after being bumped out of the U.S.

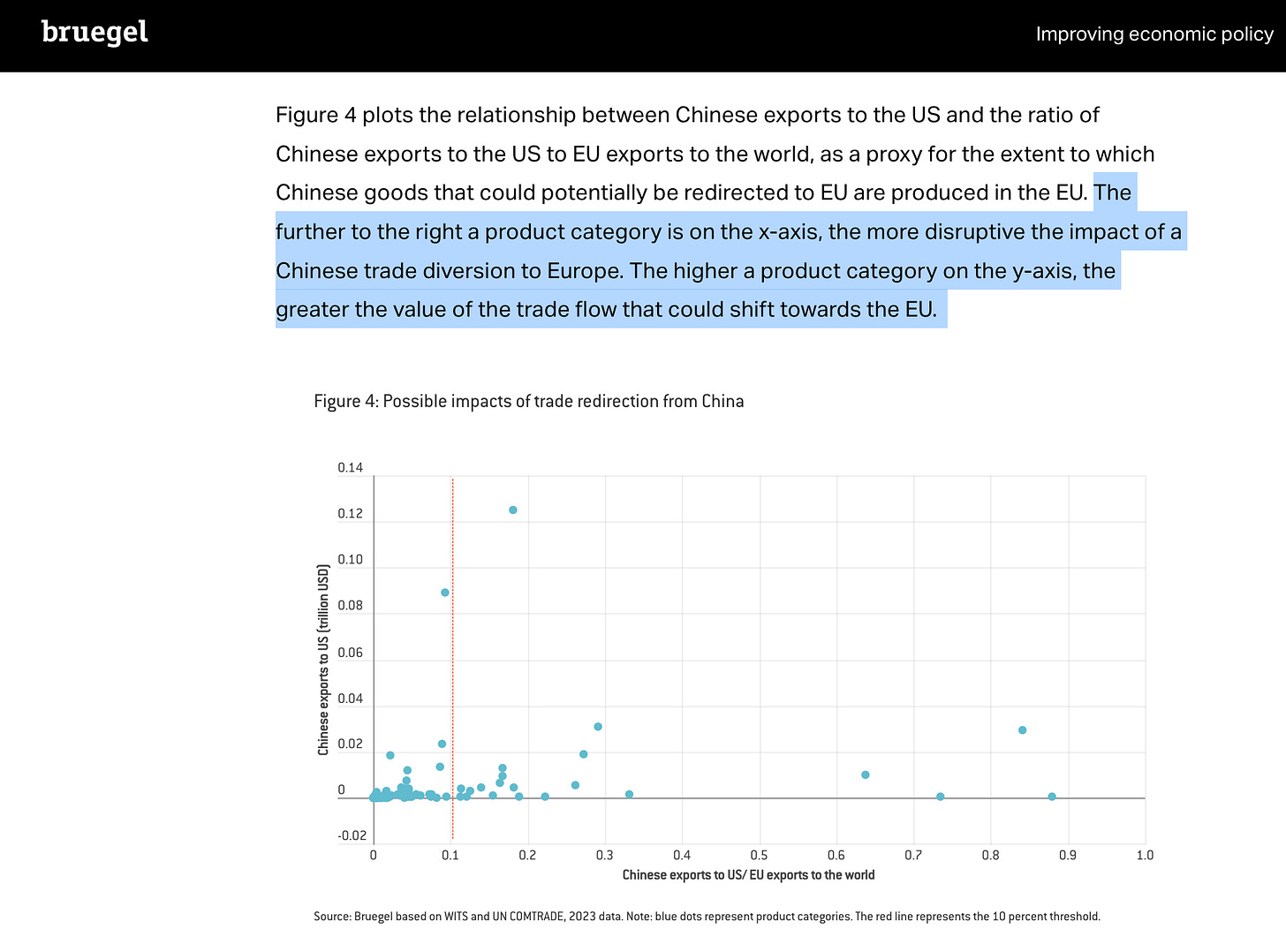

Citing a recent analysis by Brugel, the Brussels-based think tank, the commentary explains an examination of export data shows Chinese exports and EU exports are not exactly competing, the high tariffs imposed on Chinese exports by President Donald Trump since his 1st term hasn’t resulted in visible rises of Chinese exports to the EU as a percentage of overall Chinese exports, and that the EU doesn’t produce much in its most concerning product categories anyway.

The commentary boasts Chinese policy measures to stimulate domestic consumption and claims that these measures will absorb Chinese exports, which will be received with a significant pinch of salt in Brussels. The commentary also dangles Chinese trade retaliation against U.S. products, for example, the suspension of receiving Boeing passenger jets, framing it as a potential growth point for European products, which is perhaps much more convincing.

What’s also notable is that the byline of the commentary is 欧实 Ou Shi, and that the Global Times claims the writer is “an international affairs commentator.” There is no public record of anyone notable by that name, and it is widely known among China watchers that Beijing is used to using pseudonyms in messaging.

欧盟对中国“贸易转移”的担忧,没必要

The EU’s Concern over China’s “Trade Diversion” Is Unnecessary

by 欧实 Ou Shi

The European Union has recently made it clear that its tariff negotiations with the United States have no bearing on China-EU relations and that it will not “decouple” from China under U.S. pressure. This clarity is commendable. At the same time, it is worth noting that certain European politicians’ concerns about so-called “trade diversion” from China are unnecessary.

For example, European Commission President Ursula von der Leyen has warned against a potential influx of Chinese goods into Europe as a result of U.S.-China trade frictions. She even proposed the creation of an “Import Surveillance Task Force” on China. Likewise, Friedrich Merz, poised to become Germany’s next Chancellor, claimed that prolonged U.S.-China tensions would lead to a surge of Chinese imports impacting Germany more severely, urging the European Commission to take immediate action. These concerns, however, are misplaced. China-EU trade is fundamentally mutually beneficial. The entry of Chinese goods into the European market is driven by demand and economic logic, not diversionary tactics.

A recent report by Belgium’s Bruegel think tank titled The economic impact of Trump’s tariffs on Europe: an initial assessment directly challenges such concerns, concluding they are exaggerated. “Even before Trump’s latest tariff announcements there were already relatively high US tariffs on many Chinese products and only 13.5 percent of Chinese exports go to the US,”—a figure that recently rose slightly to 14.7%, according to China’s latest data. Given the distinct comparative advantages between China and the EU, the overlap in their export structures is minimal. Among the 94 product categories analyzed in the Bruegel report, only 21 showed a product overlap rate of over 10%, most of which involved very limited trade volumes. “Most represent very small trade flows, with the three most exposed categories (umbrellas, wickerwork and toys) each representing less than 0.05 percent of EU exports.”

“The most concerning product category for the EU is ‘electrical machinery and equipment and parts and thereof’, for which Chinese exports to the US were worth approximately $124.8 billion in 2023. Smartphones and lithium-ion batteries account for 31 percent and 10 percent of this category, respectively. The EU produces virtually no smartphones but wants to increase its share of global battery manufacturing. There will be certainly other products for which EU producers will face greater competition, but the risk overall seems limited and deflationary forces from trade diversion to the EU might end up being beneficial.”

One fact not included in the report is that since the U.S. began imposing high tariffs on China during the Trump administration, there has been no significant shift in Chinese exports toward Europe. From 2018 to the first 10 months of 2024, China’s exports to the U.S. as a share of total exports fell by 4.6%, while the share to the EU only increased by 0.4%.

The EU should take into account that China has already become the world’s second-largest consumer market since 2018, with domestic consumption now the main engine of economic growth. In response to the U.S.-provoked trade frictions, the Chinese government has developed a robust set of policy tools. This year’s Government Work Report placed boosting consumption at the forefront of its agenda, launching major campaigns to expand domestic demand. For instance, China introduced up to 300 billion yuan in ultra-long-term special bonds to fund large-scale trade-in programs for consumer goods, aiming to stimulate domestic consumption across the board. Therefore, even if Chinese exports face barriers to the U.S. market, China’s own consumer base will be the main channel to absorb the goods. China has neither the intention nor the need to engage in market dumping or destructive price competition.

China’s willingness to negotiate its electric vehicle tariffs with the EU through a price undertaking model shows a clear understanding of, and respect for, European concerns. In truth, Chinese exports of quality products have enriched supply in European markets, helped ease inflationary pressures, and supported Europe’s green transition. These contributions deserve to be viewed objectively and fairly.

Instead of focusing on creating an “Import Surveillance Task Force” the EU would do better to pay attention to China’s policy orientation and its positive effects. China’s shift toward expanding domestic demand and boosting consumption will also open up broader opportunities for high-quality European products and services. Notably, China is accelerating the liberalization of its services sector, responding to rising consumer demand with increased imports in health care, cultural entertainment, and other high-end services. At the recently concluded 5th China International Consumer Products Expo, Slovakia participated with a national pavilion for the first time, while France’s 90-year-old URGO entered the Chinese market. “Bringing the best products to China” has become a shared goal among European companies.

The market share in China that the U.S. is actively forfeiting due to its own trade provocations should catch the eyes of Europe more. Reports show that as U.S.-China tensions escalate, Chinese refiners have slashed crude oil imports from the U.S. by 90%, turning instead to Canadian sources. Trade frictions have also benefited Australian beef exporters, with grain-fed beef exports to China surging nearly 40% year-on-year from February to March. While American companies like NVIDIA and Boeing see their China exports plummet under the backlash of U.S.-imposed tariffs, what should Europe be doing? The answer seems self-evident.

It is U.S. tariff policy—not China—that distorts global trade. Both the EU and China are victims of such unilateral measures. Facing this hegemonic pressure, the EU should look at the bigger picture and join China in taking on the shared responsibility of major global economies to oppose unilateralism and protectionism. Europeans often say, “Every cloud has a silver lining”—much like the Chinese view of “opportunity within crisis.” With steadfast commitment to openness and cooperation, China and the EU will surely find new opportunities in adversity, benefiting each other and contributing to a brighter world.

(The author is an international affairs commentator.)