Chinese-backed Dutch takeover of UK wafer fab: Timing is everything

Analysis: Wingtech-owned Nexperia's buyout of Newport Wafer Fab under microscope

When Liz Truss or Rishi Sunak emerges as the next Prime Minister of the United Kingdom on September 5, the new British government will soon publish a highly-scrutinized decision involving China.

Technically, the decision wouldn’t be Truss’s or Sunak’s making, but current Business Secretary Kwasi Kwarteng’s .

On July 5, Kwarteng sought a further 45 working days for the ongoing national security assessment into the takeover of Britain’s largest wafer fab by a Chinese-owned Dutch firm, which he originally called in on May 25.

The deadline is therefore, if my calculation of working days holds, one or two days after September 5.

I don’t know if Kwarteng could - or would - wrap it up before the deadline. But if he doesn’t take the hot potato off the new PM’s hands, the stakes in the high-profile national security assessment will be elevated even further.

After all, not many see national security assessments as non-political in the first place, and it will be extra difficult to convince outsiders, much less the Chinese, that the new head of the UK government is not involved. Timing is everything, and the optics would just be that the UK government under a new PM kept or reversed a done deal, especially given Truss and Sunak have clashed over who would take the toughest stance on China in the race to No.10.

If recent history is any guide, the odds are not in favor of Chinese companies under Kwarteng, who wields considerable power to quash deals citing the new law.

On July 20, Kwarteng blocked the licensing of some vision-sensing technology from the University of Manchester to Beijing Infinite Vision Technology, a small Chinese private company that delivers realistic still image, animation, and virtual reality for residential cultural and commercial projects.

Last week, Kwarteng blocked the takeover of the British electronic design company Pulsic by a Hong Kong rival. Bloomberg reported Super Orange HK Holding Ltd. is “in reality controlled by little-known Shanghai UniVista Industrial Software Group, backed by the National Integrated Circuit Industry Investment Fund,” although “it’s unclear what roles Super Orange’s controlling shareholders played in the takeover attempt.”

Those two cases are small potatoes compared with the purchase of Newport Wafer Fab by Nexperia (2021 revenue $2.14 billion), a Dutch firm owned by the Shanghai-listed 闻泰科技 Wingtech (market cap $13.3 billion). The deal is reported to be worth £65m and semiconductors are everyone’s favorite subject these days.

Every single UK media outlet has spilled ink over the deal or given it airtime. In July 2021, Telegraph ran nearly two dozen stories and commentaries. One single correspondent at CNBC, an American business news TV channel, published nine text stories about the deal between July and August 2021.

They were overwhelmingly unflattering about the takeover and repeatedly featured objections from Tom Tugendhat MP, Chairman of the Foreign Affairs Select Committee and leader of the China Research Group in the House of Commons.

Recently, news coverage picked up again. For example, a year after the deal has been completed and scrutinized, The Times suddenly found anonymous sources claiming Chinese-backed Nexperia ‘hobbled’ Newport Wafer Fab to buy on the cheap because “the business was in a turnaround with great potential” (but nobody saw that happening, until now :)

At the heart of the controversy is the Chinese ownership of Nexperia. Upon the apparent assumption that Nexperia doesn’t have any agency or autonomy because of the Chinese ownership, critics say the takeover means the Chinese are in charge of Britain’s largest wafer fab and hence controversial over a number of reasons:

Newport Wafer Fab’s technology could fall into Chinese hands. But this has largely been debunked, as even Tugendhat admits “It’s not world beating or cutting edge.”

The Chinese could deliberately shut down Newport. Nexperia’s reply is that is just ridiculous and it has invested £160 million “Dutch money” to its Manchester and Newport wafer fabs - why would it shut it down and lose all the investment?

“But it’s the biggest microchip plant in Britain and it could be the building block for our own industry,” as Tugendhat wrote.

The argument that Nexperia put up is basically that with Chinese backing the Dutch firm is investing big in the fab - saving it from bankruptcy as Newport was nearly broke, keeping jobs alive, and upgrading and expanding production. All of them are an enormous contribution to the Welsh - and thus - British industry.

Critics basically are saying the UK needs to have its own semiconductor strategy and industry, and when it begins to work on it, Newport would be unwilling or untrustworthy to be a part due to its Chinese ownership.

So-called “open access.” Critics say Newport would be busy making stuff for its Chinese master and close its facilities to British partners, which could have taken advantage of “a compound semiconductor open access fab” to conduct research and development, and without which the UK couldn’t build a semiconductor cluster.

Nexperia’s defense is that such anopen access fab “did not exist and does not exist,” and it is willing to make one only if somebody is willing to pay.

Objections from the Americans, where nine Republican members of Congress have publicly threatened to no longer trust the Britons.

(credit: BBC)

What’s in Nexperia’s favor:

The takeover had been completed before the UK’s National Security and Investment Act kicked in, so this would be a retrospective assessment, and undoing a done deal would create many practical difficulties.

This is not even the British government’s first retrospective assessment. Sir Stephen Lovegrove, the National Security Adviser, had retrospectively concluded there were insufficient reasons to block the deal after being asked by Prime Minister Boris Johnson to look into the deal, as reported by Bloomberg and others.

Kwarteng himself had refused to investigate the deal in May 2021, when prodded by Tugendhat

The Government has been in close contact with Newport Wafer Fab but does not consider it appropriate to intervene at the current time.

Nexperia is a Dutch firm with good standing in the UK, including anoter wafer fab in Manchester.

Why the deal could go bad?

Strong objections led by Tugendhat. In his own words: "For over a year, the Committee has voiced its concern over the takeover of semiconductor manufacturer Newport Wafer Fab.”

Intervention from Washington. As exclusively reported in the Wall Street Journal

a diplomat from the U.S. Embassy in London told British officials in recent weeks that the factory—if back in British hands—could help the U.K. become a hub for making chips crucial to electric vehicles…The diplomat didn’t ask British officials to reverse the deal…but made it clear that the U.S. would prefer that.

Before that, nine GOP members of Congress had written to President Biden to demand his intervention.

Increasing suspicion of Chinese investment especially in sensitive sectors such as semiconductors, against deteriorating relations and trust between China and the UK (and the West in general). Chinese companies, often regardless of whether they are state-owned or privately-owned, are increasingly seen as just tools of a hostile Chinese state instead of profit-seeking entities.

The battle for PM further strains the atmosphere, as the UK-China relationship became “Casualty of Truss-Sunak Battle to Lead UK,” in the wording of a Bloomberg report.

Earlier in the race, Sunak promised five actions against “our number one threat” in trying to upend the perception he was less hawkish, including

Comments to Pekingnology by two rising China watchers in Britain

Sam Hogg, Founder and Editor of Beijing to Britain:

It's a tough call to say which way the Business Secretary's intervention could go. A decision to allow the purchase to go ahead would cause significant anger in Parliament and many would demand to know how it was allowed to go through. However, in theory, Kwasi Kwarteng and the Investment Security Unit which will be helping him make the call are operating outside of Parliamentary pressure - this will be a fact-driven, not political, decision.

Chris Cash, Research Lead at China Research Group:

Whilst not wishing to second guess the BEIS review process, the recent intervention in a Chinese acquisition of vision sensing technology from the University of Manchester, as well as the criticality of Newport Wafer Fab as a building block in creating a British semiconductor cluster, would suggest that there is good reason and precedent for the takeover to be blocked.

From Nexperia's (and Wingtech’s) side, the radio silence in response to national security objections about the takeover - notwithstanding vague commitments to keep the Newport site running - has only deepened suspicion amongst those in the UK who have taken an interest in the case. China’s drive to reduce its reliance on semiconductor imports is no secret: Nexperia is yet to convincingly argue that its Chinese ownership does not affect its business policy.

It’s only fair to note that Chinese companies, in general, could use big help in their public relations efforts in the West, and that is just me putting it mildly.

So it’s no wonder that Wingtech has gone totally radio silent, including declining to comment for Chinese media, and apparently delegated the matter to Nexperia.

In a somewhat awkward exchange, Nexperia’s publicly call for a speedy decision was quickly rebuffed.

Toni Versluijs, Country Manager of Nexperia UK, said on July 5 in oral evidence to the Business, Energy and Industrial Strategy Committee of the House of Commons:

"this investigation also needs to be done swiftly. We see that our customers are becoming impatient for clarity, along with some of our employees. Last week, on Friday, a young lady in Newport stepped into the office of our general manager and she said, “I just bought a new house. After this review, will I still have a job?” It is in everybody’s interest to give clarification, if not for Nexperia then for people like the young lady.

That is of course a touching story, and was indeed picked up by the press. But the call for a green light ASAP was snubbed on the same day by Kwarteng’s decision to delay the decision for another 45 working days.

I wonder if the Dutch firm underestimated the sensitivities unfortunately associated with Chinese ownership in the West these days and are overwhelmed by the political detraction typically unafforded to a European company.

I also wonder if Nexperia and its Chinese owner underestimated the potential consequences if the takeover is found to endanger UK national security, given their unsatisfactory public response to criticism.

Nexperia has manufacturing and R&D locations globally, including in Europe and the U.S. If it can’t survive a national security challenge in the UK, would it be too implausible that similar challenges arise elsewhere? That is to say, if Nexperia is a national security threat to the UK, wouldn’t it be one to the U.S. or perhaps even Germany? What would happen to Nexperia’s (and Wingtech’s) future expansion in the West? Why would its many Western customers source products from a designated threat to UK national security?

Some of the questions are perhaps unfair, as even if the deal is cancelled, it doesn’t mean Nexperia itself is a national security threat. But rest assured those are the frustrating questions Chinese-owned entities should be totally prepared for nowadays, especially when they are perceived as not forcefully addressing the national security objections.

Some of the objections, in my opinion, are best addressed by Wingtech rather than Nexperia, such as those concerning Wingtech’s own statements and corporate governance.

For example, Wingtech, after Nexperia’s takeover, filed a routine and standard disclosure on the Shanghai stock exchange, reminding investors

标的公司在后续经营过程中可能会受到国内外行业政策、经济环境等因素影响,提请广大投资者注意风险。

The acquired company (Newport Wafer Fab) may be affected by domestic and international industry policies, economic environment, and other factors in the course of its subsequent operation, so we draw the attention of investors to the risks.

The disclosure, by no means unique, was dramatized by a CNBC story as Chinese firm behind the purchase of the UK’s largest chip plant warns deal is at risk

Shanghai-headquartered Wingtech Technologies warned shareholders in a note this week that “domestic and foreign industry policies” present a risk to the takeover of Newport Wafer Fab, which is located in South Wales.

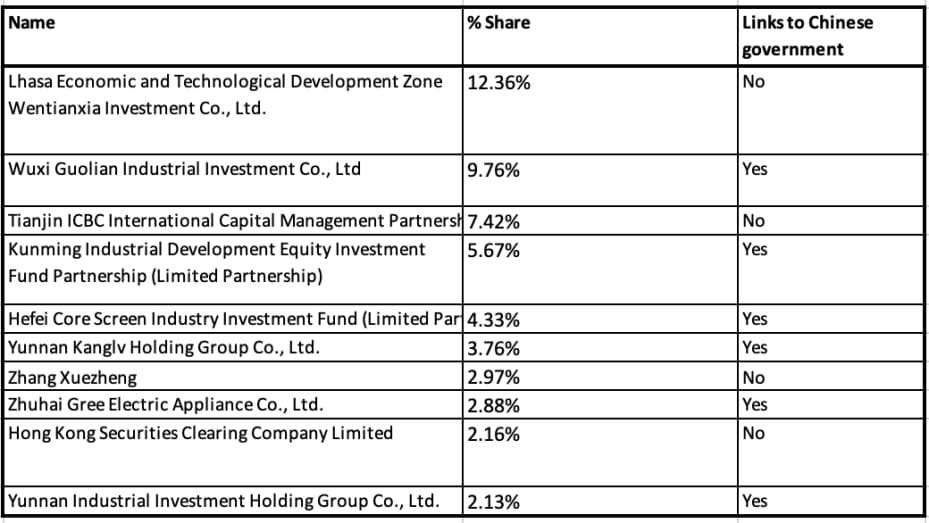

CNBC also discovered an exclusive Dutch analysis that purports to show Chinese firm behind the acquisition of the UK’s largest chip plant is state-backed.

(via CNBC report)

There is room for debate - probably a Ph.D. dissertation - on the complex nature of Chinese investment firms mixing Chinese public and private capital in publicly-traded companies. But according to Wingtech’s 2021 annual report (Chinese) on the Shanghai stock exchange, the 国家 state and 国有法人 state-owned entities held zero shares in it.

According to the annual report, its top 10 shareholders include 8 non-state-owned entities, one individual (Wingtech’s founder), and one foreign entity (Hong Kong Stock Exchange, representing stock investors in Hong Kong through the Shanghai-Hong Kong stock connect.)

Wingtech is run by its own people. According to the bios in Wingtech’s 2021 annual report, among members of the Board of Directors, Supervisory Board, and Senior Management, all but one are employed by Wingtech. The exception is one partner at a domestic accounting firm.

In another example, nine Republican members of Congress wrote to President Joe Biden in April, asking for direct U.S. diplomacy with the UK government to reverse the deal. The letter states, citing a report from the Congressional Research Service

In July 2021, Nexperia, with support from PRC state funds—Wise Capital and JAC Capital— announced it would be acquiring NWF, a UK semiconductor chip facility.

Neither the Republican letter nor the CRS report presented evidence that the two funds are involved in the acquisition. Nexperia didn’t mention that. There are no UK media reports of their involvement either. (The author of the CRS report didn’t reply to my request for comment, and I guess this is an unintentional mistake.)

The sentence also got the most basic fact wrong. Nexperia announced on July 5, 2021, that it has already “obtained 100% ownership of the Newport Wafer Fab,” not that “it would be acquiring NWF.”

Let me end this newsletter with some balanced and nuanced coverage from the Financial Times

Welsh silicon wafer plant review highlights security fears

Many in the tech industry are puzzled why so much government attention has been focused on the future of a small facility in South Wales reportedly valued at less than $100m, rather than the debate over the future of Arm, widely seen as one of the UK’s “crown jewel” tech firms, or the multibillion-dollar investment required to lure semiconductor manufacturers such as Intel to the UK.

Newport Wafer Fab, which has produced silicon wafers, the bare bones upon which processors are constructed, under various guises since the early 1980s, employs 450 people. Its low-grade wafers, a far cry from what is available at the world’s largest and most sophisticated chipmakers, are shipped overseas to countries such as China and Malaysia to be turned into chips, as no such facilities exist in the UK.

“We are not talking about bleeding edge here,” said Wayne Lam, a semiconductor analyst at CCS Insight. Given similar wafer technology is “readily available” in China, he added, Newport’s technology “isn’t worth fighting for”. “It’s more of a national pride issue than something that is going to be potentially a danger to national security.”

……

Even if there were government appetite to offer the kinds of multi-billion-dollar incentives that Intel is seeking from the EU to construct a series of new chip plants on the continent, UK tech executives are sceptical the plant in Newport could form the basis of such an enterprise.

“Could you turn that [business] into a Taiwan Semiconductor Manufacturing Company? Given a trillion dollars and a pile of expertise that doesn’t exist, maybe,” one semiconductor industry executive said, adding that the debate over Newport reflected a “complete misunderstanding at a government level” of the technological and logistical complexities of chip supply.

UK government is in semiconductor mess of its own making

The crux of the Newport case is that the plant appears pretty irrelevant on a narrow view of national security and yet significant through the wider lens of economic strategy in a high-tech sector the government says it wants to develop.

That’s a problem given it has been at pains to separate the two. Deal-vetting powers are often used overseas to protect industrial policy priorities. But economic considerations were removed from early guidance by the time the National Security and Investment Act powers came into force this year.The facility, built by government-backed Inmos before being privatised in the 1980s, makes legacy silicon wafers that are shipped to Asia to be assembled into chips. This is decidedly lower-value stuff, far from the cutting edge of manufacturing that predominantly happens in Taiwan. Even some within the sector concur with Stephen Lovegrove, the government’s national security adviser, in seeing no direct threat from its sale.

But a post-pandemic shortage of semiconductors and heightened geopolitical concerns have changed the tenor of the global conversation. The mood is such that nine US congressmen have raised the Newport sale in a letter to President Joe Biden. “The US and EU are talking in terms of strategic economic significance and pursuing ambitious strategies to retain and reshore semiconductor capacity,” says George Dibb, head of the Centre for Economic Justice at the IPPR. “This situation shows the weakness of the UK’s tool kit.”

Altice is however a worthier target for the scrutiny of the UK’s new state M&A watchdog than Newport Wafer Fab, a small semiconductor group bought by a Dutch subsidiary of China’s Wingtech.

Finally, this paragraph from a report by Sir Geoffrey Owen, an FT veteran and Head of Industrial Policy at Policy Exchange, a UK think tank

The Business Secretary’s decision will be based, as it should be, on the facts of this particular case, assembled and analysed by the Investment Security Unit, the branch of BEIS that administers the Act. But the Nexperia/ NWF affair gives the government an opportunity, which it should use, to set out its position on the wider issue of China’s involvement in the British economy.