Jiang Xiaojuan's passionate advocacy of private economy in Beijing Daily

The official-turned-professor said China's private entrepreneurs "built its fortunes on hard work and innovation," NOT exploitation

Jiang Xiaojuan, a former senior government official, is now President of the 中国工业经济学会 Chinese Society of Industrial Economics and a Professor at the University of Chinese Academy of Social Sciences.

She recently wrote in《北京日报》 Beijing Daily, the official newspaper of the Communist Party of China Beijing Municipal Committee, 发展民营经济需要各方共同努力 the development of the private economy requires collaborative efforts from all parties, where she built on the Opinions of the Central Committee of the Communist Party of China (CPC) and the State Council on Promoting the Development of the Private Economy to make a convincing and passionate advocacy for the private sector.

In addition to comprehensively reviewing the tremendous and indispensable contribution of the private sector based to the world’s second-largest economy, Jiang, effectively echoed Liu Shijin’s public call for a big Communist Party of China theory breakthrough on private entrepreneurship.

Liu Shijin calls for "breakthrough" in Party theory to allow structural reform for economy

Liu Shijin is a Former Vice President (Vice Minister) and Research Fellow of the Development Research Center (DRC), a comprehensive policy research and consulting institution directly under the State Council, the central government of the People's Republic of China.

Jiang wrote that Chinese private entrepreneurs “built its fortunes on hard work and innovation, eschewing immoral methods,” likely a reference to the sort of slavery, colonization, and exploitation condemned by Karl Marx.

Quoting official Communist Party of China documents that have long legitimized capital as one of the factors in the economy that should be compensated, Jiang also cited the works of Joseph Schumpeter in saying that entrepreneurship is a factor.

During the 1980s and 1990s, despite controlling vast production assets, many of China's state-owned enterprises grappled with extensive losses. Yet, with shifts in leadership or through restructuring of the enterprises, the efficiency of the same set of production factors could be greatly enhanced. This highlights the critical role of entrepreneurs.

In other words, these Chinese experts are NOT trying to make the case that Das Kapital or the Communist Manifesto is incorrect, BUT that the private sector and the private entrepreneurs in China today are not the same group of capitalists condemned by Karl Marx almost two centuries ago.

Former Deputy Secretary-General of State Council on foreign investment, WTO, industrial policy, etc.

Today’s newsletter features selected translations of the Academic Autobiography of Jiang Xiaojuan (Mandarin, JD.com). From 2004 to 2018, Jiang worked in the State Council, first as Deputy Director of the Research Office. Later, she was a Deputy Secretary-General of the State Council, where she was responsible for education, science and technology, cultur…

发展民营经济需要各方共同努力

The development of the private economy requires collaborative efforts from all parties

Recently, the Opinions of the Central Committee of the Communist Party of China (CPC) and the State Council on Promoting the Development of the Private Economy (referred to as the Opinions hereinafter) have been unveiled and implemented. The Opinions explicitly state that the private economy is the driving force for advancing the Chinese path to modernization, laying the foundation for high-quality development, and an important force in realizing the Second Centenary Goal of building China into a great modern socialist country in all respects. The Opinions underscores the significant emphasis and high expectations the Central Committee of the CPC and the State Council place on the private economy. I will delve into three key takeaways from my perspective.

New Top Document Promoting China's Private Economy

The Central Committee of the Communist Party of China (CPC) and the State Council have published a document dedicated to promoting the development and expansion of China’s private economy, Xinhua News Agency reported on Wednesday, July 19 evening, in an apparent effort to shore up the private sector’s confidence.

Private Economy Growth: Key to Achieving the Goal of Building China into a Great Modern Socialist Country in all Respects

At its 20th National Congress, the CPC set its mid-century goal: to fully build China into a great modern socialist country in all respects. The first step is to basically realize socialist modernization by 2035, with the per capita GDP on par with that of a mid-level developed country. To reach this milestone, a balanced focus on both the scale and quality of development is essential. This means that unlocking all growth avenues is paramount, spotlighting the private economy’s pivotal role.

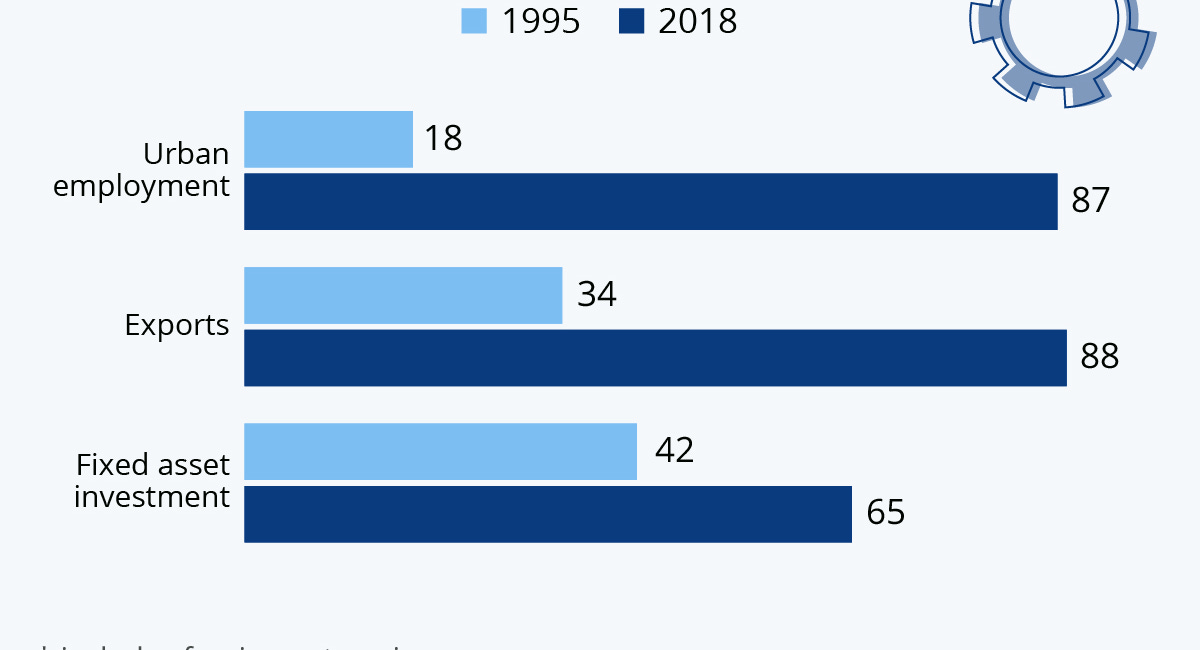

The private economy, now the primary engine of China's economic ascent, remains a decisive factor in its growth trajectory. 2021 data from the All-China Federation of Industry and Commerce reveals that private enterprises were responsible for 59% of national corporate tax revenue, 65% of GDP, and a staggering 92% of the total enterprise count. The role of private enterprises is notably pivotal in various dimensions:

Firstly, they are at the forefront of consumption growth. Through digital platforms, they seamlessly bridge vast networks of consumers and suppliers, offering cost-effective and streamlined transactions. Their ongoing service innovations position them as primary conduits for consumption expansion.

Secondly, they anchor employment and ease job transitions. In 2021, private enterprises drove a 4.8% surge in employment, with a majority—over 70%—of these firms either stabilizing or ramping up their workforce numbers. The digital platforms notably underscored their influence on employment. In 2021, while the national employment figures decreased year-on-year, large platform enterprises still managed to increase their workforce. For many of today's youth navigating the uncertainties of job transitions or short-term unemployment, these platforms offer a cushion of stability. Phrases like 'maybe I'll deliver food for now' or 'I could drive for a ride-hailing service' are emerging as lifelines for workers in flux, mitigating the mental strains of job shifts and unemployment.

Thirdly, they have cemented their role as pillars of trade stability. In the year's first half, private enterprises witnessed an 8.9% year-on-year surge in imports and exports, outstripping the general growth rate by 6.8 percentage points. Accounting for a robust 52.7% of the total trade, they fueled an aggregate rise in foreign trade by 4.4 percentage points. Digital cross-border platforms have swiftly emerged as catalysts in reshaping foreign trade, propelling a new era of trade evolution and ingenuity. According to statistics from the General Administration of Customs, from 2017 to 2021, the nation's cross-border e-commerce transactions skyrocketed, seeing almost a tenfold increase. Impressively, 2021 witnessed a 15% surge in this sector compared to the year prior.

The private economy is also a key factor influencing the quality of development. In 2022, private enterprises accounted for 72% of the "Top 500 Chinese Manufacturing Enterprises." On the global stage, among the top 10 global players in the photovoltaic industry, 8 were Chinese private enterprises. Chinese private enterprises claimed 8 of the top 10 spots in the photovoltaic industry. And of the 4,300-plus firms in China's fourth batch of 专精特新“小巨人” small and medium-sized enterprises known for their specialized, innovative technologies, a whopping 84% hailed from the private sector. Private tech firms in China represent about 50% of the national high-tech enterprises.

Presently, these companies are the driving force behind innovation, holding roughly 65% of national invention patents, spearheading 70% of technological advancements, and launching over 80% of new products. In 2022, the top ten private enterprises in terms of sales in China included companies like JD Group, Alibaba, Hengli Group, Amer International Group Limited, Huawei, Tencent, etc. These firms not only epitomize quality and technological leadership in China but also stand as global frontrunners in their respective domains. On the global stage, private enterprises have emerged as leading trailblazers in uncharted territories: exports of electric passenger vehicles, lithium batteries, solar cells, and photovoltaic modules have skyrocketed in recent years, with growth rates over 30% and some even eclipsing 50%. The private economy stands out as the main producer and exporter of these products, reshaping and energizing the nation's export structure.

Private enterprises have firmly cemented their status as powerhouses of technological innovation. Their evolving innovative prowess is especially pronounced in two distinct categories of enterprises.

First, there are those born out of universities and scientific bodies, driving a seamless melding of industry, academia, and research. They're instrumental in expediting the conversion of cutting-edge scientific advancements into practical applications, pushing key technologies from the lab to the production frontline.

Second, by tailoring technological innovations to specific market needs and application contexts, big, digital platforms curate an expansive, instant, online tech marketplace, anchored by hundreds of millions of individual consumers and millions of corporate users. Moreover, these large enterprises, with their robust muscles, channel significant investments into comprehensive technological infrastructures via research and development. The pivot from innovation to backend application is streamlined by industrial imperatives. As such, the dynamics among alternative industries is clear and smooth, eliminating any traditional "conversion" chokepoint. Currently, the top three companies in terms of research and development investment in China are all digital platform enterprises. In 2021, the average research and development investment in major domestic large-scale digital technology enterprises’ budget reached 10%, with some outliers doubling that figure. Undoubtedly, private enterprises have become the core force driving digital technology innovation in China.

Given that the private economy generates wealth prior to being in possession of wealth, its legitimacy is unquestionable.

The Opinions underscores the imperative to acknowledge the pivotal role and substantial contributions of the private economy. It calls for a balanced view of wealth accumulated legally by individuals within this sector. This key judgment shapes the societal perception of the private economy and its practitioners, influencing the value judgments across diverse societal segments.

Emerging post-1978 reform and opening-up, China's private entrepreneurs chart a path distinct from Western capitalists, many of whom historically amassed wealth through means like plunder, slavery, and colonization. Instead, China's private sector largely built its fortunes on hard work and innovation, eschewing immoral methods.

The 16th National Congress of the CPC emphasized the principle of distributing production factors such as labor, capital, technology, and management based on their contributions, thereby unleashing the potential of these production factors.

The Fourth Plenary Session of the 19th Central Committee of the CPC emphasized once again the need to refine a system where market forces evaluate the contributions of production factors, such as labor, capital, land, knowledge, technology, management, and data, and determine rewards based on those contributions.

One of China's notable institutional strides since its reform and opening-up era has been the facilitation for many with modest capital to swiftly transition into entrepreneurial roles, spurring wealth creation.

In today's fast-paced market economy, driven by technological advancements, entrepreneurs stand as pivotal orchestrators of factors of production. Distinct from static factors like capital, land, and equipment, entrepreneurs possess the agency to determine how best to allocate and employ these resources. Building on the insights of Joseph Schumpeter, economists have long underscored the pivotal role of 'entrepreneurs' or 'managers.'

During the 1980s and 1990s, despite controlling vast production assets, many of China's state-owned enterprises grappled with extensive losses. Yet, with shifts in leadership or through restructuring of the enterprises, the efficiency of the same set of production factors could be greatly enhanced. This highlights the critical role of entrepreneurs. Investors, while vetting projects, place significant emphasis on the core management team in today's market dynamics. This trend underscores the market's heightened regard for entrepreneurial prowess.

Entrepreneurs are a group of risk-takers who initiate innovative actions, willing to create novel combinations of production factors (which is the essence of innovation) and undertake the risks of innovation. In sectors driven by emerging technologies and evolving business models, where the link between effort and outcome is unpredictable, the prowess of an entrepreneur often outweighs mere ownership. This holds particularly true in our rapidly advancing tech era. The innovation brought by entrepreneurs is the core driving force behind social development. Due to the extreme importance of such talent and actions, with the support of capital markets, those who succeed in innovation can amass a significant amount of wealth in a short period, which serves as a reward for innovation. The network and digital technology further amplify their reach, allowing cutting-edge products and services to penetrate global markets efficiently with low costs, gaining substantial market share.

Those in the top echelons of income – the top 1% and 10% – are increasingly dominated by the 'salariat'. This group, amassing considerable equity and income through successful startups and market listings, has now surpassed those whose wealth is anchored in inherited capital and dividends. The mechanism of "wealth creation" in the market has diverged significantly from the traditional capitalist society.

Creating a Favorable Development Environment for the Private Economy Requires Collaborative Efforts from all Parties

Private enterprises are making a strong case for sustained policy support. Current support measures, targeting small and medium-sized enterprises, lean heavily towards these private entities. Ensuring not only a level playing field, these policies often tip the scale in their favor, offering preferential terms and conditions. Data from the State Taxation Administration show that, over the last five years, these enterprises have received tax reductions, exemptions, refunds, and deferred tax benefits amounting to over 8 trillion yuan, accounting for about 70% of the total. Particularly, 80% of 个体工商户 individual business households, as members of the private economy, are now exempt from taxes after the implementation of preferential tax and fee policies. Approximately 80% of the service resources from the national tax authorities are directed toward private enterprises. In a tangible example of the policy's impact, information regarding corporate tax credit has been instrumental for financial institutions. This data acts as a pivotal reference when extending loans, especially to small and micro enterprises. As a result, these smaller entities have secured 22.46 million bank loans, amassing an impressive 6.22 trillion yuan in total lending. Future policies supporting enterprise development should continue to lean towards small and medium-sized enterprises to help them thrive.

Large private businesses, notably platform enterprises, are in need of a more favorable environment to thrive. A combination of robust systems, supportive policies, and positive public sentiment can offer the boost they need. It comes as some of these major private entities, particularly platform companies, grapple with dwindling confidence, reduced innovation, and a decelerating growth trajectory.

The Opinions emphasizes guiding society to objectively and comprehensively understand the private economy and private entrepreneurs. Besides understanding the value of their innovation, their contributions to growth and employment, and the legitimacy of their wealth, a key aspect to be addressed in policy formulation and public discourse is emphasizing that large platform enterprises are essentially science and technology companies. China's major platforms across diverse sectors are surging ahead, fueled by relentless technological innovation and evolving business models. Recognizing these entities as prominent science and technology enterprises not only streamlines their development and governance but also facilitates informed decisions on monopoly-related issues. Such clarity aims to steer societal and public viewpoints towards a more correct understanding of the growth of these large platforms.

In the era of digital technology and intelligent development, competition ramps up, making a deep dive into the intricacies of “confidence” is essential. Digital technology and intelligent development technologies iterate and innovate rapidly, ushering in new companies and business models at breakneck speed. In this high-intensity competitive environment, faltering even for a moment can spell challenges. Even in traditional industries, most new startup enterprises fail, a rate that is even higher in the digital intelligence sector. A 2021 snapshot reveals the volatile landscape: of the top 500 global unicorns, 152 were replaced —a whopping 30.4% turnover. Even more startling, 86 were completely wiped off the map, marking a 274% surge in eliminations year-on-year.

In the ever-evolving tech landscape, even industry giants with large platforms are finding the challenge of staying current and continuously innovating a formidable one. A growing trend has hit the tech industry: key technology experts from major platforms are departing in droves, lured by fresh entrepreneurial opportunities. This mass migration is posing a formidable challenge for established tech giants.

These days, inertia is synonymous with regression. The vitality of new enterprises coexists with the confusion and sense of powerlessness of existing ones. No policy can promise a flawless growth atmosphere for them. To survive and thrive, they mount constant effort and determination.

A favorable development environment requires collaborative efforts from all parties. The Opinions says that various forms of ownership should have equal access to production factors, participate in market competition on an open and fair basis, and be equally protected in accordance with the law. As a consensus, an environment for business that is "equal" and "fair" is essential for stability, credibility, and sustainability. The below are some key issues to address.

Firstly, there exists unequal market access. In the digitalization process of certain large-scale application scenarios, services offered by privately-owned platform companies are being met with reservations, and even some projects previously undertaken by these platforms have been withdrawn. It is necessary to afford equal opportunities to enterprises of all kinds upon the premise of security. Selection should be based on market standards through competitive bidding.

Second, different criteria are used to judge competitive behavior. For instance, the measurement of monopolistic practices seems to be applied only to private enterprises. Regulatory oversight with market influence of this nature should be impartial.

Third, regulatory agencies often send mixed signals. Regulatory ambiguity is on the rise as various entities within China's administrative and judicial systems often send divergent messages. They have different job responsibilities, and it's necessary to coordinate efforts and align policy direction and communication to promote development and ensure everyone's on the same page.

At the same time, private enterprises, especially platform enterprises, should recognize that they hold considerable influence over social order and values. Their actions, even if not guided by intentions to create monopolies or hinder fair competition but rather driven by the technology capabilities to connect vast amounts of data, can still lead to consequences that affect fair competition. In this age of heightened public awareness, a company's reputation can be its lifeline or downfall, and it’s more important than ever to ensure its own development. Thus, building a favorable development environment requires collaborative efforts from all parties.

Liu Shijin calls for "breakthrough" in Party theory to allow structural reform for economy

Liu Shijin is a Former Vice President (Vice Minister) and Research Fellow of the Development Research Center (DRC), a comprehensive policy research and consulting institution directly under the State Council, the central government of the People's Republic of China.

New Top Document Promoting China's Private Economy

The Central Committee of the Communist Party of China (CPC) and the State Council have published a document dedicated to promoting the development and expansion of China’s private economy, Xinhua News Agency reported on Wednesday, July 19 evening, in an apparent effort to shore up the private sector’s confidence.

How Academic Research Contributes to China's Decision-Making

Today’s Pekingnology features a part of the《江小涓学术自传》Academic Autobiography of Jiang Xiaojuan (Mandarin, JD.com), sharing her thoughts on the role of academic research in China’s policy-making. 江小涓, Jiang Xiaojuan, is a scholar turned Chinese official who served as 副主任Deputy Director (2004-2011), 国务院研究室 Research Office of the State Council, and then 副秘书长…

I read Marx in the English translation, and it was clear Marx was condemning Capitalism as a system, not capitalist as a class nor capital itself. Capitalism will always give rise to capitalist. I wonder what version of Marx (or Lenin's excellent work on the late stage of capitalism, Imperialism) the professor studied and if something was lost by either the English or Chinese translations.