These 11 Chinese mainstream economists all call for govt aids to Chinese households

They know Beijing’s “reluctance to directly distribute money to the people is still quite evident” and want to change decision-makers' minds. Will they succeed?

Today’s newsletter is a round-up of 11 high-profile Chinese economists’ calls, in the past five months, for direct aids from Beijing to Chinese households. They include two former vice ministers, three deans at prestigious Chinese universities, and two deputy directors-general at the Chinese Academy of Social Sciences. They are all in China’s mainstream discourse working with state or state-affiliated employers. (Sorry, Ting Lu at Nomura, which we have covered.) Their advice range from more vague “public services” to cash handouts and consumption vouchers with trillion-yuan tags. Some of them believe source of the spending could come from re-directing funds for construction, some believe China should issue more debts, and two say either the profit or the share of the numerous state-owned enterprises (SOEs) should be directly distributed to the people.

As one of them observed, Beijing’s “reluctance to directly distribute money to the people is still quite evident.” Their public advice address some apparent concerns on the government’s mind. Against Beijing’s vow “not to fall into the trap of ‘welfarism’ that encourages laziness,” one says it’s difficult to tell “who is lazy and who is not,” and making social security a universal and foundational safety-net is increasingly a necessity and inevitability. Another says that’s merely a technicality that can be overcome. Many try to persuade Beijing that spending money on people rather than projects will not bankrupt China’s public finances, not to mention that “the ultimate goal of economic development is to improve the living standards of the people.”

And there is a concensus, or at least an overwelming majority, that the aids could at least go to low-income groups such as migrant workers or cush falling birth rates.

Below are their advice in detail. (And I’m sorry it’s an all-male panel.)

Liu Shijin is a former Vice President of the Development Research Centre (DRC), equivalent to a Vice Minister. He called for spending at least one trillion yuan in 2024 alone to subsidize housing for farmer-turned-workers in a lecture at Tsinghua University on April 2, which we have covered in two parts [1] [2]

In recent years, policies have repeatedly emphasized expanding domestic demand and consumption. The premise is to identify the bottlenecks and key challenges. There are two key points.

1. Development-oriented consumption relying on basic public services.

2. The low- and middle-income groups, especially farmer-turned-workers

Some believe that equalizing basic public services for farmer-turned-workers is merely government "subsidizing." This is a misunderstanding. Farmer-turned-workers have long worked in cities and paid taxes, yet the government has failed to provide corresponding basic public services, essentially accumulating a debt. Now, it is simply paying back this debt.

In recent years, all annual sessions of the National People's Congress and the Chinese People's Political Consultative Conference have proposed various investment projects worth hundreds of billions, but no local government has announced plans to address the basic public service issues for farmer-turned-workers. From the perspective of expanding domestic demand, if a city already has ten subways, it is more beneficial to use that money to solve housing and public service issues for farmer-turned-workers rather than building two more subways. Governmen-subsidized housing would prompt farmer-turned-workers to decorate and buy furniture and bring their families to the city, driving significantly more consumption than additional subways.

Some argue that there is no money for basic public service equalization, but funds can be raised by shifting investment from physical capital to human capital. In 2024, the Chinese government plans to issue 1 trillion yuan in ultra-long special treasury bonds. The priority should be solving the basic public service problems for farmer-turned-workers.

Cai Fang is former Vice President of the Chinese Academy of Social Sciences, equivalent to a Vice Minister. He told an internal meeting of China Finance 40 Forum, one of China's most influential think tanks in the field of finance and macroeconomics, on July 28

The Resolution [of CPC Central Committee on further deepening reform comprehensively to advance Chinese modernization, in July ] mentions the need to "refine the systems of basic public services, with the focus on providing inclusive services, meeting essential needs, and providing a cushion for those most in need." This statement carries profound implications. As China's income levels continue to rise, the quality of people's lives increasingly depends on basic public services to meet their needs. In other words, at the current stage of development, the quality of life for the people is determined not only by household income and related consumption expenditures but also by an increasing demand for public goods provided by the government. From the commonalities of modernization across countries, whether it's Wagner's Law or the theory of The Affluent Society, both reveal the basic rule that as development advances, the boundaries of public goods continually expand outward.

China has undergone a process of building a social security system from scratch and gradually expanding it. For a long time, social security constituted the main part of basic public services in China. At that time, the construction of the social security system emphasized "low-level, broad coverage," which was a specific embodiment of achieving fairness and justice and adhering to the principles of doing one's best within one's means at the development level of that period.

Today, China's basic public services have expanded to cover seven aspects across the entire life cycle: ensuring care in childhood, education, gainful employment, access to medical care, support for the elderly, housing, and assistance for the vulnerable. The Resolution emphasizes "providing inclusive services, meeting essential needs, and providing a cushion for those most in need," which is the latest expression of achieving fairness and justice and adhering to the principles of doing one's best within one's means. Here, I will highlight three main aspects that need to be grasped.

First, the social security system should be improved with a more universal approach. Efforts should be made to improve the national coordination of basic pension insurance, build a unified national social security platform, enhance the funding and benefit adjustment mechanisms of social security, raise the basic pension levels, and establish and improve a multi-pillar social security system covering key populations, the employed, and groups facing special difficulties.

The rapid development of technology inevitably brings changes to the environment of social mobility. For example, the replacement of jobs by machines and artificial intelligence is unavoidable; employment mobility will also increase, making job transitions and job-hopping more common; and under such circumstances, the difficulty of identifying those who require social security has greatly increased—for instance, it becomes challenging to distinguish who is lazy and who is not. At this time, social security and basic public services, with their increasingly universal, foundational, and safety-net characteristics, become both inevitable and necessary.

Let’s now move to three deans in China’s most prestigious universities.

Huang Yiping, Peking University Boya Distinguished Professor, Dean of its National School of Development, and a current member of the Monetary Policy Committee at the People's Bank of China, said in a public lecture on May 23

It is essential to increase the intensity of macroeconomic policies, especially by swiftly implementing the already planned fiscal expenditures. In 2023, the broad fiscal spending has significantly lagged behind the initial plans made at the beginning of the year, and it appears that this trend is continuing. The policy mindset of "emphasizing investment while neglecting consumption" should be changed, and measures to support consumption growth should be confidently adopted. These measures include facilitating the settlement of migrant workers in cities and directly distributing money to the general public.

Huang told a conference on June 12

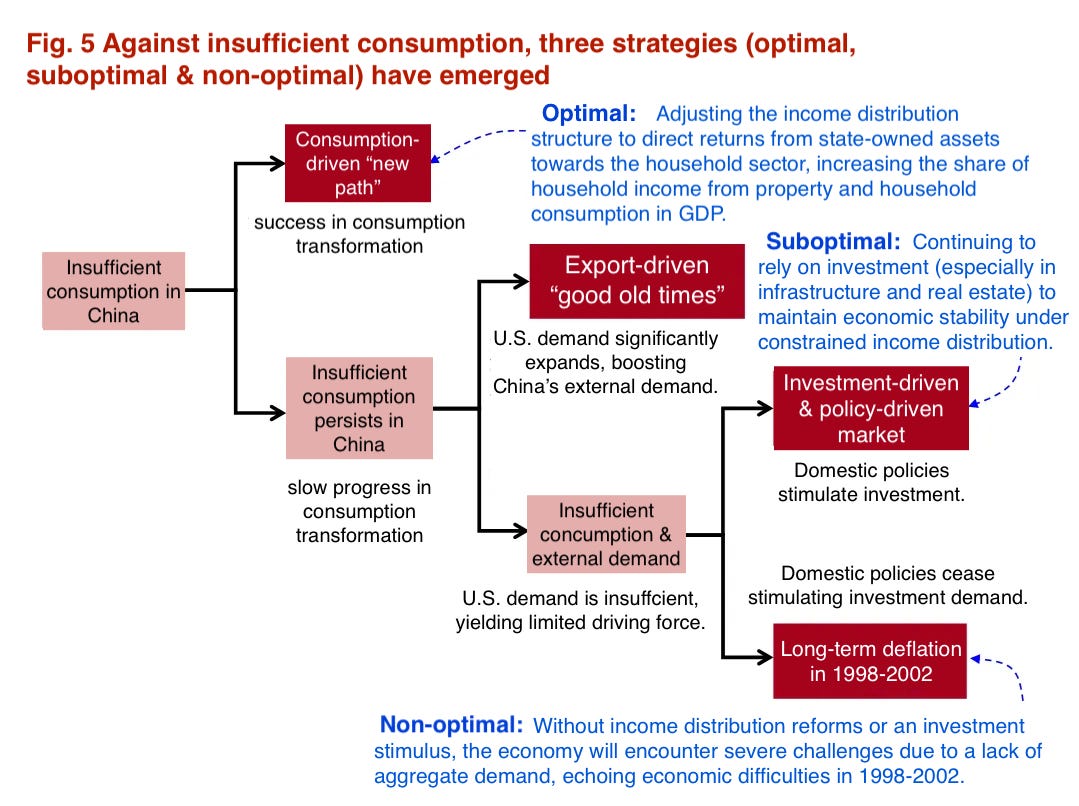

For a long time, economic growth has been driven by investment. Later, some scholars suggested shifting from investment-driven growth to consumption-driven growth. The economic community holds diverse views on this matter—some economists advocate for a shift toward consumption-driven growth, while others firmly believe that investment remains the true driver of growth.

Perhaps the debate over whether growth is driven by investment or consumption is not as crucial as it seems. What is most important is maintaining a relatively reasonable balance between investment and consumption. If everyone focuses solely on consumption without investment, growth is unlikely to be sustainable—a problem that the United States has faced in the past. Conversely, if investment is prioritized without adequate consumption, significant issues can arise. Investment must ultimately be converted into productive capacity, and if this capacity produces goods that cannot be sold, the investment cannot be recouped. This scenario may lead to excess capacity and hinder sustained growth.

Therefore, boosting consumption is a clear strategy, and there is no need to spend excessive time debating the relative importance of consumption versus investment. The key lies in achieving a relatively reasonable balance between these sectors. In the past, imbalances were mitigated by relying on international markets, but this has become increasingly difficult as China has grown into a major economy.

The importance of consumption is self-evident. After all, the ultimate goal of economic development is to improve the living standards of the people. Increasing consumer spending is essential for absorbing the products generated during the production process. If the people lacks money, sustained consumption is unlikely to be feasible for anyone. Therefore, pursuing a reasonable balance between investment and consumption is a task that must be undertaken from today onward.

At present, China's policies seem more adept at supporting investment and supply, while support for consumption appears less developed. This year, some new policies have been introduced, such as the trade-in program for consumer goods, which are good policies and have had a significant impact. However, the effectiveness of trade-in programs can vary; if people are already cutting back on consumption, the effects may be greatly diminished. Additionally, the government's reluctance to directly distribute money to the people is still quite evident. This isn't necessarily a suggestion for the government to hand out money on a large scale right now, but it is an issue worth further consideration. Many officials oppose giving money to the public due to concerns about encouraging laziness, uncertainty about distribution channels, worries that people might not spend the money, and the challenge of determining how much to give to different groups. However, these are technical issues that can be overcome. Even if some micro-level aspects [of implementation] are not perfect, they are not major problems. The purpose of distributing money is not only to improve people's lives but also to boost overall demand. When businesses receive orders, they can expand production, hire more workers, and increase investment, which could accelerate economic growth.

Only with a rise in consumption can economic growth be sustained. If consumption remains sluggish and people's living standards do not improve significantly, where will the strong and sustained momentum for economic development come from? Consumers, producers, and investors are more likely to fall into a vicious cycle of low expectations.

Perhaps it is time to consider changing the policy approach, boldly and confidently supporting the enhancement of consumption. Enhancing consumption is essentially enhancing supply and is a crucial force in promoting the development of new productive capacities. Of course, "stimulating" consumption cannot be achieved by issuing empty promises to the public. As part of a macroeconomic policy, the government should genuinely spend real money, whether by raising social security levels, solidifying the welfare benefits of permanent urban residents, or even directly distributing money to the public. Only then is it possible for the macroeconomic momentum to truly stabilize and recover.

Zhang Jun, Dean of School of Economics at Fudan University in Shanghai, said in an interview on June 19

China's economy has already become quite big, and in the current period of global economic downturn, public policy has become increasingly important. Given that the benefits of large-scale investment in driving growth are diminishing, rather than allowing investment to turn into debt or be wasted on unfinished projects, it would be more prudent to promptly adjust the structure and model of fiscal expenditure. A greater portion of public spending should be directed towards households, providing more support to families, especially low- and middle-income families, in areas such as housing, healthcare, childcare, and eldercare.

Zhang wrote on July 15 in his Project Syndicate column

more must be done through policy changes to support consumer spending. For policymakers, this means not only channeling more income and transfers toward households, but also increasing subsidized or free in-kind transfers to them.

A strong social safety net is particularly important in China, where decades of family-planning policies have encouraged households to save at exceptionally high rates, partly in anticipation of supporting parents and, ultimately, themselves in old age. If households can be certain that they will have strong family-based support and welfare programs from governments, so that they don’t need to save so much today, they are likely to consume more and might even have more children, thereby helping to stem China’s demographic decline. (The current fertility rate – about 1.1 births per woman – is well below the replacement level).

Ultimately, China must shift to a growth model that supports the growth of household disposable incomes, rather than continuing on the path of excessive capital accumulation. To that end, the government must encourage higher-wage economic activities, such as in the service sector, and strengthen the business environment, not least by expanding the decisive role of market forces in resource allocation.

Liu QIao, Professor of Finance and Dean in the Guanghua School of Management, Peking University, wrote on August 15 in the official newspaper of the Central Commission for Discipline Inspection, the Communist Party of China’s watchdog

Further increase the issuance of government bonds, particularly ultra-long-term bonds. Compared to the scale of government bond issuance in Western developed countries, there is still considerable room for growth in China's government bond issuance. Secondly, fiscal policy should increasingly tilt towards the final demand side and the consumption side. For example, funds raised through government bond issuance could be directed towards education, technology, and talent development. Additionally, transfer payments to low-income groups could be used to boost their willingness and capacity to consume. There should also be an intensified effort to support small and medium-sized enterprises (SMEs), including measures such as tax reductions and exemptions.

Let’s then move on to two Deputy Directors-General at the Chinese Academy of Social Sciences. Both Zhang Bin and Zhang Ming, unrelated, are students of Yu Yongding.

Zhang Ming, Deputy Director of the Institute of Finance & Banking, Chinese Academy of Social Sciences, wrote in the 7th Issue of China Banking, a journal of China Banking Association

Regarding fiscal policy, my recommendations include the following:

First, without exceeding the 3% limit of the central fiscal deficit to GDP ratio for 2024, the Chinese government can increase the issuance scale of long-term special government bonds, for example, raising the scale from 1 trillion yuan to 2-3 trillion yuan. The funds raised through the issuance of additional special government bonds can be allocated to four areas:

1. Issuing consumption vouchers to low- and middle-income households. Considering that if cash subsidies are provided, low- and middle-income families might choose to save the subsidies, issuing consumption vouchers that expire within six months could have a stronger effect on boosting consumption in the short term.

2. Providing more subsidies to small and medium-sized enterprises, such as interest subsidies on loans.

3. Using the funds to replace part of the local debt of central and western provinces.

4. Supporting local governments in acquiring some of the idle apartments and converting it into affordable housing.

Second, in the context of economic slowdown, current fiscal revenues are likely to shrink. If the 3% central fiscal deficit limit is strictly adhered to, the resulting fiscal spending will inevitably contract accordingly, making fiscal policy pro-cyclical. Therefore, under the current circumstances, it may be appropriate to seek approval from the National People's Congress to raise the central fiscal deficit as a percentage of GDP, thereby providing the Ministry of Finance with greater operational flexibility.

Zhang Bin, Deputy Director-General of the Institute of World Economics and Politics, Chinese Academy of Social Sciences, wrote in Study Times, the official newspaper of the Central Party School, on June 26. (On May 23, Zhang Bin briefed Xi before the Third Plenary Session.)

China currently has over 180 million rural migrant workers. Most of them cannot return to rural work and life but also find it challenging to settle in the cities where they work and enjoy urban social welfare and various supporting public services. Cultivating this group of rural migrant workers into new urban residents and a new middle-income group, profoundly changing the lives of hundreds of millions of families, is a 人心所向 popular demand by the Chinese people and a significant promotion of social equity.

China, now in the mid-to-late stages of industrialization, has the capacity to enable rural migrant workers to settle in cities and enjoy urban life. Ensuring housing security, basic education, medical services, and social welfare for rural migrant workers requires a two-pronged approach. On the one hand, lowering entry barriers to encourage and support non-governmental capital investment and using market forces to meet demand; on the other hand, expanding the supply of residential land in metropolitan areas, improving infrastructure and public services in these areas, and providing appropriate subsidies for newly settled or low-income families.

In the long run, settling rural migrant workers in cities does not increase the public fiscal burden. Rural migrant workers settling in cities will enhance urban economies of scale and consumption capacity, expanding the tax base. Historical and international experiences show that urbanizing more population leads to simultaneous rapid growth in fiscal expenditure and revenue without affecting public finance sustainability.

David Daokui Li, Professor of economics and director of the Academic Center for Chinese Economic Practice and Thinking (ACCEPT) at Tsinghua University, is among the most vocal economists in Chinese media these days. He has been calling for direct subsidies for quite some time, and on July 11 put forward a trillion-yuan proposal that he believes should be implemented in October (good luck!)

From the perspective of long-term institutional reform, the entire government's operational orientation needs to be changed by reforming the fiscal and tax systems and local officials' assessment indicators to shift government incentives from investment and project-oriented policies to policies that provide basic social welfare and help people increase disposable income to boost consumption, transforming the government from an investment-oriented government to a social welfare service-oriented government.

in the second half of 2024, opportunities must be seized to launch short-term policies to boost consumption and enhance the short-term growth vitality of the Chinese economy. For example, the central government could issue consumption vouchers worth one trillion yuan during the Golden Week in October to encourage or subsidize public consumption. Based on the multiplier effect of issuing consumption vouchers, one yuan of consumption vouchers could lead to about four yuan of consumption, increasing government tax revenue.

According to the ACCEPT's calculations, issuing consumption vouchers would ultimately not deplete central fiscal revenue but would boost consumption confidence, market prosperity, and the overall trajectory of China's economy.

Mao Zhenhua is Founder of China Chengxin Credit Rating Group, co-director of Renmin University’s Institute of Economic Research/China Macroeconomy Forum, and a professor at the University of Hong Kong’s Business School since 2022. Mao told the South China Morning Post on August 5

Starting from 2020, I recommended economic stimulus in the form of consumer vouchers be given to those who had been hit hard by the pandemic. Later, I went further to say consumer vouchers or cash subsidies should be given to every resident. But there hasn’t been any meaningful action taken on this front.

Over the past two years, I have proposed to offer consumers 10 trillion yuan (US$1.4 trillion). On paper, this is a very large figure. It represents about 8 per cent of GDP, surpassing the current red line for the fiscal deficit at 3 per cent of GDP.

In fact, how big is 10 trillion yuan? It’s not a small number, but it’s not a big number either. This would translate into 7,000 yuan for each person, or about US$1,000. We know that the US gave away thousands of dollars, and Hong Kong also offered residents cash.

So how do we fund the spending? I think a fiscal deficit is one way, but there are other options. For example, there are a large number of state-owned enterprises in China, and they have 4.6 trillion yuan in profits. You can transfer that to residents through local governments, and half of the problem is solved. If 10 trillion is not possible, then 4.6 trillion is not a small amount either.

The key is, what does the government do with the money? I think the efficiency of directing funds to infrastructure spending is low, while the benefits of giving it directly to residents is high and will have a better impact for businesses. If the money goes to consumer spending and increases demand, I support it. But if money goes to government departments, which don’t use funds efficiently, I oppose it.

State-owned enterprises cannot become the main bodies of innovation. Innovation must come from large companies and privately-owned companies. For example, advanced national defence technology is built on the development of technology companies from the private sector. This is also the case in the US. If we did not have a market-oriented environment, companies like drone maker DJI would not have such status now.

James Jianzhang Liang is one of the Co-founders and the Chairman of Trip.com Group, one of the leading global travel service providers. He is also a Chinese population economist and a Professor of Economics at Peking University's Guanghua School of Management.

He wrote in his WeChat blog on July 11 that

Addressing the current insufficient economic demand through proactive fiscal policies is gradually becoming a consensus among economists. Some economists advocate for stimulating consumption by issuing consumption vouchers, but I believe direct cash payments are easier to implement and do not favor specific products or industries. A better and fairer method is to give money to families with children, as they bear the burden of raising children for society and help address China's severe low birthrate problem…

Providing direct payments to families with children can stimulate consumption and investment confidence in the short term. By giving money to households, various consumption demands can be stimulated and increased. Offering better loan policies to these multi-child families for home purchases can further stimulate the real estate sector. In the long term, an increasing population can enhance China’s innovation capacity and competitiveness. Population is crucial for innovation due to the scale effect. Large populations give countries and their businesses a significant advantage. Stable macroeconomic growth and a favorable economic environment also improve overall fertility rates, creating a virtuous cycle.

Encouraging childbirth through fiscal transfers to households does not waste social resources. If such incentives result in families having more children, the future contributions of these children to society will outweigh the initial financial support, generating positive returns and creating more wealth.

Our suggestion to stimulate the economy with direct payments differs from the 4 trillion yuan plan proposed during the 2008 financial crisis. The 2008 stimulus primarily targeted affordable housing and infrastructure construction. Our proposal involves direct payments to households, especially those with children. Providing money to families with children offers more long-term returns than traditional infrastructure investments. The key to determining whether direct financial support is healthy for the economy lies in whether it yields long-term positive returns. Investing in excess capacity or inefficient infrastructure projects could exacerbate overcapacity and financial bad debts in the future. However, providing financial support to families with children will not lead to overinvestment but will result in more urgently needed newborns.

The funding for child-rearing subsidies comes from general taxation. Some may question whether this is fair to single or childless families. In the long term, it remains fair because the future tax and social security contributions of these children will benefit everyone, including those without children. The current tax and pension systems effectively have child-rearing families subsidizing those without children. Providing child-rearing subsidies corrects this imbalance. Children are the future innovators, builders, workers, and taxpayers. Therefore, supporting families raising children is not only fair but also essential.

Xu Gao is Chief Economist and Assistant President of Bank of China International Co. Ltd., and also an adjunct professor of the National School of Development at Peking University.

Xu’s advice goes the furthest. He believes income redistribution is not enough without letting the 1.4 billion Chinese citizens directly owning the shares of and thus benefiting from its vast state-owned enterprises (SOEs). Xu said in March at the National School of Development at Peking University

The "optimal strategy" focuses on income distribution reforms through the implementation of a "Universal Shareholding Scheme for SOE Stocks," which aims to increase the share of household income in the GDP, thus enhancing consumption's contribution to the economy and steering towards consumption transformation.

To elevate the share of consumption within China's GDP, increasing household income is an essential first step. Without a substantial rise in household income, attempts to boost consumption may not achieve their intended impact. As the above analysis underscores, income distribution reforms in China should not just enhance household incomes but also, more importantly, create a market mechanism that dynamically adjusts the distribution of income between the household and corporate sectors based on the ROI, which must act as a critical price signal.

Simply boosting household income is not enough. It is pivotal to grant the public decision-making power over operational, investment, and dividend decisions in enterprises. Large SOEs in China provide a unique opportunity to pursue this strategy. Since these enterprises undoubtedly belong to the public, the logical progression is to facilitate the public's direct exercise of their ownership rights. This move aims to make state assets tangible, accessible, and beneficial to the people, thus directly bolstering consumption. This strategy is further discussed in the article "Why SOE stocks should be distributed among all citizens" [which has been translated & published by The East is Read.]