Tsinghua scholar advocates progressive carbon tax in China

Prof. Jiandong Ju isn't sure the carbon market alone is enough.

This is the fourth newsletter from Pekingnology of a series of speeches made by guest speakers at the 2021 Tsinghua PBCSF Economic Forum on Carbon Neutrality held on September 16.

The forum was widely covered in Chinese media but not so much in English so your Pekingologist wishes to present a more domestic detailed, technical discussion from the forum on reaching China’s carbon goals - China aims to reach the carbon peak before 2030 and carbon neutrality before 2060.

This particular speech is made by 鞠建东 Jiandong JU, Unigroup Chair Professor at PBC School of Finance in Tsinghua University and also with Research Center for Green Finance Development, where Prof. Ju talked about why he thinks a carbon market alone is insufficient to stimulate Chinese market entities towards carbon neutrality and his proposal of a progressive carbon tax.

By the way, the carbon tax is making a comeback to Washington.

The translation is based on a transcript in Chinese of the speeches shared by the forum’s organizer with over several dozen Chinese media journalists in a WeChat group, and full video documentation of the forum is available at Tsinghua PBCSF’s Twitter account with simultaneous translation in English. Therefore, technically the speech was already in the public arena, but in case you want to quote something here, a link or mentioning of Pekingnology is appreciated.

Please note this is a partial translation, to save both your times and ours. The full transcript in Chinese will be pasted at the end of this newsletter for reference.

For more on the forum: the speech by a senior executive of CATL, the leading Chinese battery giant, the speech by the head of China National Nuclear Power, and the speech by the President of Sinopec.

***

Today, I will mainly talk about two tools: the carbon market and the carbon tax.

The carbon market is the most discussed topic now. My point of view is that it is very difficult to achieve carbon neutrality only by relying on the support of the carbon market. China has piloted the carbon market in eight provinces and cities since 2013, and the national carbon market has started to operate in July 2021, which is still immature.

At present, China's carbon quota is distributed free of charge, with a quota of 4 billion tons, exceeding the European Union's 2 billion tons. It is worth further discussion on whether the carbon quota should be distributed free of charge or auctioned when it comes to the optimization of resource allocation.

At present, the carbon trading in China's carbon market is only spot trading, without extensive participation of financial institutions and effective price discovery tools such as futures, options, forwards, and swaps.

However, the EU carbon market is rich in financial products and active in futures trading. From the perspective of liquidity, the liquidity of China's carbon market is very low. The turnover rate of China's carbon market is about 5%, while that of the EU is 400%, which is 80 times that of China.

From the perspective of the carbon price, China's carbon price is about 50 RMB per ton, while the EU's carbon price is 50 euros per ton, which is about 7.6 times that of China. Therefore, to develop and improve the carbon market, greater progress should be made in the legislation (total emission reduction, quota issuance method), quantification, pricing, and other aspects.

In addition, referring to the development of other domestic factor markets, such as capital market, futures market, intellectual property market, and even football market, development hasn’t been a smooth ride.

The carbon market is a brand-new market with [unclear], and there will be many difficulties in its development. Therefore, it will be a very long process to establish a well-developed carbon market and it’s likely that it will be an imperfect market for many years like other factor markets. I think it is very difficult to achieve carbon neutrality in 2060 with the sole support of the carbon market.

If the carbon market (alone) can't make it, there are other administrative practices, such as switching off electricity and withdrawing the loans from coal producers which would do great harm to the enterprises and the economy. Another common and mature practice in the world is the carbon tax.

To make Pekingnology sustainable, please consider buy me a coffee or pay me via Paypal.

I think we can take progressive carbon tax into consideration.

First of all, it is necessary to clarify what “green” means. My definition is to calculate the average of carbon density in different industries, and those with carbon emissions below the value can be defined as green, while above can be defined as non-green, which shall be punished.

For example, suppose that the average value of the power generation industry’s carbon density is 600g/kWh, then enterprises emitting carbon less than the average value can be defined as green. Suppose that the average value of the carbon density in the transportation industry is 100g/km, then the enterprises’ average carbon emission less than 100g/km can be defined as green. Suppose that the average consumption of residents is 10 tons per person each year, then carbon emission from one resident’s consumption below 10 tons per person each year can be defined as green.

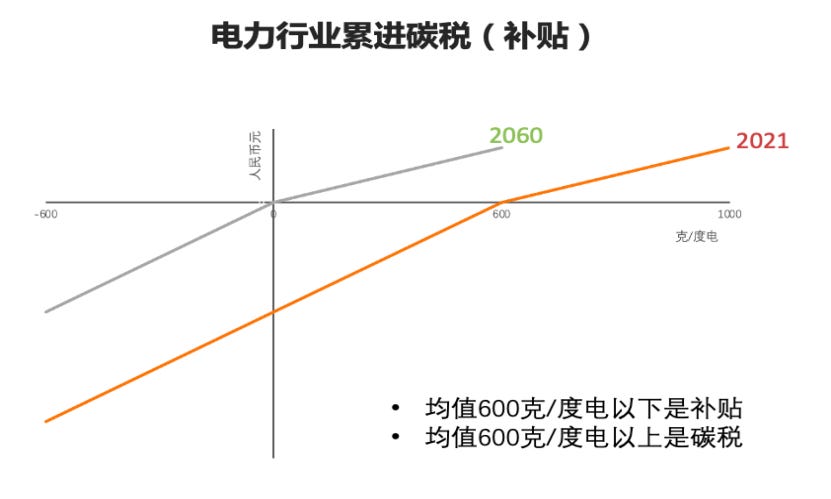

Taking the power generation industry as an example, the horizontal axis is carbon emission intensity (grams/kWh), and the vertical axis is RMB (yuan).

The curve indicates the size of the carbon tax (subsidy) levied on enterprises with different carbon emission densities, and the slope of this curve shall change, that is, the higher the carbon emission density, the greater the tax rate.

From 2021 to 2060, this carbon tax (subsidy) curve will continue to move left [from the orange to the gray], that is, the average carbon emission will change from 600g/kWh in 2021 to 0g/kWh in 2060. Enterprises with carbon emission density below the average of 600g/kWh can be subsidized, and the carbon tax can be levied on those above 600g/kWh.

At present, in the power generation industry, the carbon emission density of coal-fired power must be higher than the average, while that of natural gas power generation may be slightly lower than coal-fired power, and the carbon emission density of photovoltaic and other clean energy is even lower.

By punishing coal-fired power with high carbon emissions and subsidizing low-carbon power generation such as those on clean energy, enterprises can choose their own combination: reduce thermal power generation, increase solar power generation and hydropower generation, and get subsidies as long as their carbon emissions are below the average value.

Take the carbon tax (subsidy) of residents' consumption as an example, which would relate to income distribution. Let us suppose that the average carbon emission from residents' consumption is 10 tons per person each year, and one who emits over 10 tons every year will be taxed, one who emits below 10 tons subsidized. Carbon emissions from residents' consumption come from driving, building houses, running a private jet if you are rich, etc.

From the perspective of residents' consumption, it is obvious that the rich produce more carbon emissions and the poor produce less. Therefore, the rich should pay more carbon taxes, while the poor bear less tax burden. Individuals can also reduce their carbon emissions by planting trees. By 2060, the average carbon emissions will be 0, the average should be zero - realizing carbon neutrality in residents’ consumption.

The first advantage of taking the average value for each industry is that through this improved carbon tax method, it is easy to get the support of the enterprises. Half of them will support it because they are below the average value, and the other half may oppose it because they are above the average value.

Another advantage is that it is flexible to set different average values in different industries, and the setting of the average value could also be flexible, which makes it easy to gain support from relevant parties and get policies passed.

Unlike some current practices, if we take strict administrative transformation measures against the whole industry, the whole coal-fired power industry and the whole power-generation industry may oppose.

In addition, in countries with strong administrative implementation capabilities like China, it is more effective to adopt carbon tax than relying on the carbon market.

Based on the analysis above, we have put forward a specific economic path to achieve carbon neutrality, which is to promote the continuous decline and circulative iteration of the average carbon emissions of various industries through a progressive carbon tax, so as to achieve carbon neutrality in 2060.

***

Translated by Alexander Wang, copyedited by Zhixin Wan, and reviewed by Zichen Wang, founder of Pekingnology.

To make Pekingnology sustainable, please consider buy me a coffee or pay me via Paypal.

For your reference, below is a transcript of Prof. Jiandong Ju’s speech. Please note again the English translation above is only partial.

各位领导,各位嘉宾,各位老师们、同学们,大家好!我是清华大学五道口金融学院绿色金融发展研究中心的鞠建东,首先,我谨代表清华大学五道口金融学院绿色金融发展研究中心欢迎各位嘉宾的到来,也感谢各位线上线下海内外朋友们的聆听。今天,我想从经济学的角度谈一谈对实现“碳中和”路径的思考。我的发言主题是“两山理论与累进碳税(绿色补贴)的初步思考”。

两山理论,也就是“绿水青山就是金山银山”,如今已成为一句耳熟能详的话。这一理论最早是16年前,也就是2005年8月15日,时任浙江省委书记的习近平同志在访问浙江安吉考察时提出的。“绿水青山”等于“绿色”、“金山银山”等于“金融”,两山理论就是绿色金融的指导思想。“绿水青山”有了、“金山银山”有了、那 “绿水青山就是金山银山“中的“是”字,该怎么理解,如何去实现呢?在我看来,这是一个“绿山变金山,金山化绿山”的“不断循环迭代”过程,而这一“不断循环迭代”的过程把我们指向了“奔向碳中和”的道路。

我把实现碳中和总结为三个结构性的转变:科技实现+经济实现+金融实现。科技实现是最直观的要求,现在绝大多数的讨论就是科技实现,比如光伏技术、氢能技术等。碳中和的主要技术路径思路就是从终端用能的再电气化、到前端电力生产的零碳(低碳)化,再到多余排放的负碳抵消。但科技实现跟经济实现、金融实现不是一回事,不仅需要科技实现,还需要经济实现和金融实现。宏观层面的经济实现,意味着供给和需求需要保证供给方从高碳生产(资源依赖)到低碳生产(技术依赖)转换时,需求方从高碳产品与服务向低碳产品与服务转换时,替代的低碳技术/消费方式的市场价格是大于等于成本的,否则在经济上根本无法实现。另外是微观层面的金融实现,金融支持需要贯穿科技实现的全过程,实现从技术研发与孵化、商业化、生产过程、全产业链管理的全过程覆盖。技术的研发与孵化需要用绿色低碳创投基金等资金去支持,技术商业化需要用绿色债券、投资、贷款等优于市场成本的资金去支持,生产过程需要充分利用碳市场/碳配额获益等金融手段支持,全产业链过程,包括材料和配件的供应、生产、销售和使用过程,也需要配套绿色金融支持方案。

金融实现去支撑科技实现,金融工具至关重要,今天我主要谈两个工具,碳市场和碳税。碳市场是现在大家谈论最多的。我的观点是仅仅依靠碳市场支撑实现碳中和是很难做到的。我国碳市场从2013年起八省市地方试点,到2021年7月全国碳市场开始运行,现在仍处于不成熟的状态。目前,我国碳配额是免费发放的,配额规模40亿吨,超过欧盟的20亿吨,碳配额发放方式选择免费发放还是竞价拍卖,哪种更有利于资源配置值得进一步探讨。现阶段中国碳市场仅为现货交易,没有期货、期权、远期、互换等有效的价格发现工具,缺乏金融机构的广泛参与,而欧盟碳市场金融产品丰富,期货交易活跃。从流动性来看,我国碳市场流动性很低,中国碳市场换手率大约5%,而欧盟是400%,是中国的80倍。从碳价来看,中国碳价约50元人民币每吨,而欧盟50欧元每吨,大约是中国的7.6倍。因此,碳市场的发展与完善还需要在立法(减排总量、配额发放方法)、量化、定价等多个方面有长足的进步。此外,参考国内其他要素市场的发展状态,如资本市场、期货市场、知识产权市场、甚至是足球市场,发展过程都并非一帆风顺。碳市场作为一个全新的、定义了权限的市场,发展将存在诸多困难。所以,建立一个完善的碳市场是一个非常漫长的过程,很可能像其他要素市场一样做了很多年还未搞好,我认为靠碳市场支撑去实现2060年碳中和是非常困难的。

碳市场做不到,还有其他行政的做法,比如拉闸断电、直接给煤炭企业抽贷,这种行政做法对企业和经济伤害很大。另外一种在国际上比较普遍和成熟的做法是碳税。碳税主要是指对碳排放征税,对每吨碳排放征税,是环境政策最重要的工具之一。不同产品税率会不同,如每升汽油碳税2.9美分,每立方米天然气碳税2.3美分。从全球范围来看,发达国家中的加拿大、欧盟、澳大利亚已经实施碳税,日本已对石油、煤、天然气征税,新加坡已经实施,印度和南非计划2022年实施。美国多次提出但尚未实施碳税,英国、中国尚未实施碳税。

现在实施的碳税也有一些问题,我们现在所说的碳税都是单一碳税,即排放每吨碳税要征收多少钱。单一碳税的模型结果主要存在以下五个问题。第一,单一碳税在碳减排初期有很大的推动,但长期再想降碳就非常困难。初期主要打击煤炭等行业比较容易,后期希望大家都把汽油车换成电动车,很多人就非常不愿意。模型计算表明,单一的碳税50美元一吨能够有效降低碳排放的50%,但是从降50%到碳中和需要非常高的单一碳税,要降低碳排放80%,碳税需要超过100美元一吨。第二个问题是在初期阶段,对煤炭、煤电行业打击太大。这个原因比较容易理解,因为煤电在电力行业占比较高,且煤电已经存在很多可替代的手段。第三个问题是碳税的模型计算对宏观经济影响不大,可以为正也可以为负,但都在GDP的1%之内。第四是对收入分配的影响,大家都害怕碳税对穷人打击比较大,对穷人收的税比富人高,因为一般比较穷的地方会烧煤取暖、用煤发电等。不过碳税对收入分配是恶化还是改善,结果并不一定,取决于碳税收入该如何用。把碳税收入再分配给穷人,可能碳税对收入分配的影响就是正面的。第五个问题是现有模型一般认为,碳排放的社会成本可能大大高于现行的碳税,有些理论计算甚至认为,碳排放的社会成本达到250美元每吨。

既然单一碳税存在这么多问题,那为什么要一定要搞单一碳税?我的观点是可以考虑不同的碳税。第一,税可以是异质的,行业不同,税率可以不同;同一行业,碳排放密度越高,税率应该越高。第二,税可以是动态的,随着时间变化而有所调整。第三,税不仅应该惩罚污染,也应该与鼓励绿色并重,负的碳税就是碳补贴,可以用碳补贴的方法来鼓励绿色产业。第四,税收应该兼顾经济增长与收入分配。通过税的不同,来实现我们一开始提到的“绿山变金山,金山化绿山,循环迭代,奔向碳中和”。

对于非单一碳税的具体设置,我认为可以考虑累进碳税。首先,要明确什么是绿色,我的定义是不同行业取碳密度的中间值,均值以下是绿色的,均值以上是非绿的、需要惩罚的。比如,假设电力行业均值是600克/每度电,那么小于均值我们就定义为绿色;假设交通行业均值是100克/每公里,小于100克我们定义为绿色;假设居民消费的均值是10吨每人每年,小于均值10吨就定义为绿色。以电力行业为例,横轴是碳排放强度(多少克/度电),纵轴是人民币(元),曲线表示对不同碳排放密度企业征收的碳税(补贴)大小,且这个曲线斜率会变,即碳税征收随着碳排放密度越高,税率越大。从2021年到2060年,这条碳税(补贴)曲线将不断左移,也就是碳排放均值从2021年的600克/度电到2060年碳中和的0克/度电。企业碳排放密度在均值600克/度电以下是补贴,600克/度电以上征碳税。现在电力行业,煤电碳排放密度一定是高于均值的,天然气发电可能比煤电略低,光伏和清洁能源等形式碳排放密度更低,这都取决于行业碳排放均值的大小。通过惩罚高碳排放的煤电,补贴清洁能源等低碳排放发电,这种均值以下补贴和均值以上惩罚的方式,使企业可以自己选择组合,减少火力发电,增加太阳能发电、水力发电,只要做到均值以下就可以获得补贴。

再以关乎收入分配的居民消费碳税(补贴)为例。假设现在居民消费的碳排放均值是10吨/人年,多于10吨/人年的缴税,低于10吨/人年的补贴。居民消费中的碳排放来自于开车出行、盖房子、富人开私人飞机等。从居民消费来看,很明显富人碳排放高,穷人碳排放少。那对富人收的碳税多,穷人收的碳税少,个人也可以通过种树等形式降低个人碳排放,到2060年碳排放均值是0,从居民消费上也达到了碳中和。

通过这样改进的碳税方式,对每个行业取均值,第一个好处是容易获得企业的支持,一半企业会支持,因为他们在均值以下,另外一半的企业可能会反对,因为他们在均值以上。另一个好处是通过分不同行业设置均值具有灵活性,均值大小设置也具灵活性,容易获得各方支持,政策也更容易通过。不像现在的一些做法,若对整个行业都采取严格的转型行政措施,可能使得整个煤电、整个电力行业都是反对的。此外,像中国这样行政执行力强的国家,通过碳税方式比碳市场的方式更为有效。

基于以上分析,我们就提出了一个碳中和实现的具体经济路径,这个路径就是通过累进碳税,来推动各行业碳排放均值的不断下降和循环迭代,从而实现2060的碳中和。

谢谢大家的聆听!以上是我从学术角度同大家的探讨,不足之处在所难免,也请大家多多指正。