Yi Gang on China's Digital Yuan

Former Central Bank governor lectures on the theories and practices of China's ambitious central bank digital currency

China appears to be the most ambitious among major economies to develop its central bank digital currency - the digital yuan, and we have covered its development before.

On October 10, 2023, Yi Gang, China’s central bank governor between 2018 and 2023 gave a public lecture at Tsinghua University entitled 数字人民币的相关理论与实践 Theories and Practices Related to the Digital Yuan. The one-hour, videotaped talk gives a comprehensive and accessible introduction, including:

China’s digital yuan follows the principle of "possession equals ownership" just as cash.

Unlike other digital currencies studied by the European Central Bank and other major central banks that are mostly on the “wholesale” path, China’s digital yuan has taken the “retail” path, serving not just between banks and the central bank but penetrating individuals and companies.

The digital yuan does not contradict or replace WeChat Pay or Alipay, China’s dominant mobile payment system run by non-governmental entities.

To ensure the balance of privacy of payment and compliance for anti-money laundering or anti-terrorism financing, the digital yuan adopts a “manageable anonymity” principle, enabling small-amount transfers being conducted in a category of wallets that only require a mobile phone number to open an account, without the need to provide a name and ID number. [Yi appears to omit the fact that China currently requires all Chinese mainland mobile phone numbers registered with a government-issued ID, although admittedly that requirement is outside of the People’s Bank of China’s jurisdiction.]

China’s digital yuan operates under a dual-layer structure in practice. The first layer is the central bank issuing its digital currency to banks, WeChat Pay, Alipay, and major mobile operators. The second layer is these operating institutions providing Digital Yuan services to residents and enterprises. Under such a dual-layer system, the central bank does not directly provide services to individuals and enterprises, thus not changing the original financial service model.

Unlike bitcoins, the management of digital yuan is centralized, due to two reasons: a distributed, blockchain structure can’t cope with high volumes of transactions and the digital currency is the central bank’s liabilities and needs to be managed by the central bank just as cash.

The digital yuan will have minimal impact on monetary policy because the two-layer structure does not change the existing financial market structure and the transmission mechanism of monetary policy.

The central bank has also taken care to prevent disintermediation where people would park their money at the central bank instead of banks.

The full translation follows - but before that, an advertisement

Theories and Practices Related to the Digital Yuan

Today, I will share with you the topic of the Digital Yuan, mainly introducing the research and development background and the theoretical significance of the Digital Yuan, as well as briefly introducing the pilot programs and applications of the Digital Yuan.

1. Viewing the Digital Yuan from the Perspective of the History of Currency Development

Throughout thousands of years of civilization in our country, there have been multiple currency reforms, each driven by technological progress and socio-economic development, with the Digital Yuan being no exception.

1.1 Major Currencies in Our Country's History

Metal currency has dominated the history of human currency for thousands of years and has been significant in the currency history of China. Throughout China's thousands of years of civilization, the currency used by the people for market transactions has always been primarily copper coins. Ancient Chinese currency consisted of main and auxiliary coins, which had relative values to each other. The ancient Chinese currency system was essentially divided into two stages: the Qin-Han and the Ming-Qing periods, with the former mainly using gold and copper coins, and the latter mainly using silver and copper coins. Between the end of the Eastern Han Dynasty and the Ming Dynasty, a period of more than twelve hundred years, the form of currency was in a state of extreme chaos.

The main use of gold and silver historically was for rulers to collect taxes and for wealthy merchants to store wealth, suitable for large transactions. However, gold and silver coins were not officially minted for circulation in an official capacity. Some dynasties, like the Song Dynasty, minted some gold and silver coins mainly for rewards, birthday celebrations, and burial ceremonies. Some gold and silver coins circulated among the people, mostly kept as treasures. There were also instances where people commissioned goldsmiths to make gold and silver coins, which usually bore auspicious phrases.

During the Ming Dynasty, with the massive influx of overseas silver, China gradually formed a currency system centered around "silver for large amount, coins for small amount". In the middle of the Ming Dynasty, during the Jiajing period, various copper coins began to establish a price relationship with silver. By the time of the Wanli period (around 1580 AD), after Zhang Juzheng became the Grand Secretary of the Ming Dynasty, he implemented a series of reforms, among which the promotion of the "Single Whip Law" throughout the country was a significant aspect of Zhang Juzheng's reforms. Simply put, the main contents included reforms in both land tax and labor service, recalculating land, simplifying tax burdens, integrating labor service into the land tax, and converting taxes from goods and labor to silver. In essence, the promotion of the "Single Whip Law" established an implicit or de facto silver standard system nationwide, with silver becoming the main body of the currency unit and value scale, while copper coins continued to circulate widely in daily transactions. Zhang Juzheng, as the Grand Secretary of the Ming Dynasty, advanced reforms with the emperor's approval, significantly strengthening the silver standard system domestically and influencing the global flow of silver for more than 200 years thereafter.

So why were metal currencies able to dominate the history of human currency for thousands of years? An important reason is the high value of precious metal currencies; they are naturally the best commodities for currency, used for payment and value storage, giving holders a great sense of security. As for how they were cut, traded, and circulated, along with copper and iron coins, that was a matter of technical level.

1.2 The Digital Yuan Secures the Right to Cash Withdrawal in the Digital Era

As mentioned above, in the metal currency system, people felt secure holding precious metals. At the same time, China, throughout thousands of years of civilization, did not have a relatively systematic legal currency system arrangement until modern times. In the late Qing Dynasty, the Qing government issued decrees intending to establish a 银元券 silver yuan notes system, but the release time was in 1909, close to the 1911 Xinhai Revolution, so the Qing government did not have the time to truly establish a legal currency or paper currency system. The actual implementation of the legal currency system in Chinese history began with the currency reform issued by the Nationalist Government in November 1935, from which the legal currency system was officially established.

However, after the establishment of the legal currency system, the problem of currency value stability soon arose. Everyone knows that holding paper money is different from holding silver and gold; paper money faces the problem of preserving value. If there is over-issuance of currency and inflation, paper money will depreciate, such as the significant depreciation of the 金元券 gold yuan notes issued by the Nationalist Government during China’s Liberation War (Civil War), severely shrinking purchasing power and causing great losses to the people holding gold yuan certificates.

After the establishment of New China (People’s Republic of China), the Communist Party of China and the government attached great importance to the issue of currency value stability. The Law on the People’s Bank of China also clearly stipulates that “The objective of monetary policy is to maintain the stability of the value of the currency”. In the past years, our country has not experienced serious inflation, and the yuan has maintained stable purchasing power, and the people's money has not depreciated.

In the modern financial system, people have deposits in banks, and balances in WeChat and Alipay accounts, but there is still a need for cash withdrawal, that is, the demand for cash. What is the function of cash? Cash is the last resort when financial institutions are at risk. For example, if there is a problem or negative rumor about Bank A, depositors of Bank A may rush to withdraw cash, leading to a run on the bank. To stabilize everyone's confidence and tell everyone that their deposits are actually safe, it is often necessary to display a large amount of cash at the counter of Bank A and extend the working hours for withdrawal, allowing everyone to withdraw openly. For many people, taking out cash and putting it under the mattress at home feels secure. This demand for cash withdrawal is a legitimate right of the people that must be protected at all times.

The Digital Yuan provides an alternative way for everyone to withdraw cash, allowing bank deposits to be converted into Digital Yuan. The Digital Yuan is also a liability of the central bank, and the central bank has an obligation to redeem it, equivalent in security to cash. Moreover, with the development of technology, the proportion of cash transactions may decrease, and many people may not carry cash when going out now, able to pay with just a phone. In this environment, people still need a choice for cash withdrawal, and the Digital Yuan provides such an option.

2. Theoretical System of the Digital Yuan

The Digital Yuan is China's digital currency. It is important to clarify that the digital currency discussed here specifically refers to the Central Bank Digital Currency (CBDC), not including cryptocurrencies like Bitcoin that are not issued by central banks. CBDC is legally equivalent to fiat currency and is also backed by national credit.

2.1 Development Background and Necessity

The first question to answer is why we need to develop the Digital Yuan.

First, it can improve the efficiency of currency issuance and the central bank's payment system. Second, it can provide a backup for our payment system. Third, it can promote inclusive finance and transactions for special groups and specific occasions. The most important aspect is the third one, namely serving the people, supporting the real economy, and improving the business environment.

Our country's financial services are highly inclusive, with a very high proportion of people having bank accounts, but there are still groups not covered by financial services. The Digital Yuan can further extend coverage. Special groups include the elderly, disabled, and short-term visitors to China who find it inconvenient to open bank accounts; specific occasions mainly refer to transactions managed by smart contracts, such as post-disaster reconstruction and medical insurance expenditures, which require tracking the flow of funds through smart contracts. Similarly, in foreign trade transactions and insurance protection, it is necessary to track the movement of goods and match it with the flow of funds. Managing these situations with the smart contract of digital currency is more effective.

2.2 Value of the Digital Yuan Based on Property Rights

One entry point to understanding the Digital Yuan is that its value is based on property rights. Cash follows the principle of "possession equals ownership", meaning that anyone who takes cash out of their wallet, whether it's digital currency or banknotes, and pays you, then the payment process is completed. For example, if I have 100 yuan, and I pay you 100 yuan, the transfer of ownership and property rights of this 100 yuan is completed, without needing any other confirmation steps, which means possession equals ownership.

The Digital Yuan embodies value as a token, and its value is based on property rights. No matter which electronic wallet is used when I pay you with the Digital Yuan, the ownership of this Digital Yuan is transferred to you. The transfer of property rights is very intuitive; once given to you, it belongs to you, which is the principle of possession equals ownership.

However, bank deposits do not work this way. The transfer of our deposits has to go through the bank, and the bank has to transfer a check to the payee through the bank's account. The transfer of accounts within the same commercial bank can be completed within the bank's internal system, but cross-bank transfers, such as from the Industrial and Commercial Bank of China to the Agricultural Bank of China, still need to go through the central bank's payment system.

Regarding the future direction of digital currency, there is much discussion internationally. A rather fashionable theory is that the future of digital currency should be a tokenized deposit, such as the discussion on this concept by the Bank for International Settlements (BIS). But token and deposit have different legal meanings; a token is based on property rights, and the transfer of a token can be directly completed through the transfer of physical objects. However, as a deposit, i.e., a bank deposit, its transfer has to go through the banking system, and most of the time, it also has to go through the central bank's payment system, involving a third party in the process. Another legal difference is the difference in anonymity; for example, if I give you 100 yuan in cash, only the two of us know, but if you make a payment to the payee through the banking system, the transaction is fully traceable. So, these two seemingly similar processes have different legal meanings behind them.

Specifically for China's Digital Yuan, we have chosen the direction based on property rights, similar to gold, silver, and cash, following the rule of possession equals ownership. At the same time, the Digital Yuan can also be 松耦合 loosely coupled with bank accounts, meaning the Digital Yuan can also be based on bank accounts, or it can be solely based on property rights without being based on bank accounts. From this perspective, the Digital Yuan spans both token and deposit, bridging the attributes of property rights and bank deposits, which is an important aspect of understanding the Digital Yuan.

2.3 Digital Yuan Focused on Payment Function

Currency has multiple functions, including serving as a measure of value, medium of exchange, store of value, and means of payment. The first function is as a measure of value, which then facilitates its role as a medium in the exchange of goods. As the number of goods increases, bartering and pricing transactions become very difficult, such as equating ten watches to one phone, which is hard to manage. However, if currency is used, pricing each watch and phone in currency makes it much more convenient, which is the measure of the value function of currency.

In the modern commodity economy, one very important function of currency is as a means of payment. Students from the School of Economics and Management (of Tsinghua University), other schools of Tsinghua University, and other universities attending this lecture, if you plan to delve into digital currency, especially the central bank's digital currency, you will gradually find that digital currency is actually most closely related to payment tools. It is necessary to learn, research, and understand digital currency from the perspective of payment.

In the discussion of digital currency, there is also a hot topic, that is, whether the digital currency to be developed by the central bank is a retail type digital currency or a wholesale type digital currency. We have clearly stated in the Digital Yuan white paper published by the People's Bank of China that China will take the path of retail digital currency, but the digital currencies studied by the European Central Bank and other major central banks are mostly choosing the wholesale path.

What are the definitions of wholesale and retail? Transactions between the central bank and financial institutions are wholesale. If the path of wholesale CBDC is taken, then the use of digital currency is limited to transactions between the central bank and various financial institutions, and the so-called various financial institutions are those with accounts at the central bank, such as banks, but some securities firms and other financial institutions that do not have accounts at the central bank cannot be included. As long as one party in the transaction is an individual, enterprise, public institution, or government department, then this payment transaction belongs to retail payment.

Through this definition, we can understand that the retail direction actually includes the wholesale direction. The path of retail digital currency is much more difficult than the path of wholesale digital currency, requiring much more in terms of system and infrastructure coverage and depth. As long as retail can be done, wholesale can definitely be done, because wholesale is transactions between the central bank and financial institutions, which are relatively simple and involve larger amounts. Once it involves customers of financial institutions, i.e., digital currency can be held by individuals, enterprises, government departments, and public institutions, then this digital currency becomes a retail digital currency. The retail digital currency direction is much more complicated.

In the retail direction, we ultimately want to make the Digital Yuan a universal payment tool. Some students might ask, now that WeChat, Alipay, and other electronic payment methods are very convenient, why do we still need to develop the Digital Yuan? In fact, the Digital Yuan does not contradict WeChat and Alipay, nor is it a replacement relationship. Previously, everyone's WeChat and Alipay were based on bank accounts, and the funds circulated in them were deposits in bank accounts. After the development of the Digital Yuan, the funds circulated in WeChat and Alipay can also be entirely Digital Yuan, and both bank account deposits and the Digital Yuan can be used for electronic payment.

2.4 Three Principles of the Digital Yuan

In the white paper published by the People's Bank of China, we emphasized three principles for the Digital Yuan. The first is the principle of serving the people, serving the broadest masses of the people. The second is marketization, to give full play to the role of market mechanisms, not to squeeze out the original market services, and to provide Digital Yuan services in a market-oriented manner. The third is legalization, including personal privacy protection, legal protection of property rights, and so on.

The three principles of the Digital Yuan are consistent with the main principles discussed internationally. In international discussions, the group of central banks has also reached some consensus on the principles that digital currency needs to adhere to, forming the following three principles.

The first is the principle of “do no harm" - the development of digital currency should not harm the current duties or authorizations of the central bank.

The second is the coexistence principle meaning digital currency and cash coexist, and other financial services also coexist, and cash services will not be stopped.

The third is the innovation and efficiency principle meaning using innovative technology to improve the efficiency and security of the payment system, giving residents and businesses more choices.

It is particularly worth mentioning that under the principle of legalization, the Digital Yuan needs to strike a balance between privacy protection and compliance. Compliance means abiding by the law, to comply with anti-money laundering and anti-terrorism financing regulations. At the same time, we need to protect privacy, which is a relatively difficult balance.

How do we achieve this balance? Mainly through 可控匿名 managed anonymity. We divide the Digital Yuan wallets into four categories, among which the wallets in the fourth category have relatively small amounts and can basically achieve complete anonymity. However for large transactions, some requirements for cash management, such as the international practices of anti-terrorism financing and anti-money laundering, must be met. We set the required information for account opening according to the classification of the upper limit of the transaction amount, that is, the higher the transaction amount limit, the more information the financial institution and other service providers need to know. But the smallest amount of the fourth category of wallets only requires a mobile phone number to open an account, without the need to provide a name and ID number, etc., thus protecting privacy as much as possible under the premise of legal compliance.

[Zichen’s note: China currently requires all Chinese mainland mobile phone numbers registered with a government-issued ID, although admittedly that requirement is outside of the People’s Bank of China’s jurisdiction.]

Related work strictly adheres to the Personal Information Protection Law and the requirements for reporting large and suspicious transactions, and sets up firewalls in internal control, strictly keeping personal information confidential and not leaking it. When analyzing big data, sensitive personal information such as names and other information is generally filtered out before processing, and when viewing the results of big data analysis, it is not possible to trace back to the original sensitive personal information.

2.5 Dual-Layer Operation Structure

The Digital Yuan operates under a dual-layer structure in practice. The first layer is the People's Bank of China issuing Digital Yuan to operating institutions, including state-owned big banks, as well as WeChat, Alipay, and the three major mobile operators; the second layer is these operating institutions providing Digital Yuan services to residents and enterprises. Under such a dual-layer system, the central bank does not directly provide services to individuals and enterprises, thus not changing the original financial service model. Residents who previously opened accounts in a certain bank can continue to open Digital Yuan accounts in the same bank, and those who previously used Alipay and WeChat can still use the Digital Yuan through Alipay and WeChat. Thus, without changing the original service model, the Digital Yuan penetrates individual usage and retail links.

Under the dual-layer operation system, we still adhere to the centralized management model of the central bank, rather than adopting blockchain or distributed architecture.

We adopt a centralized architecture, mainly considering two aspects. First, centralized management can greatly improve payment efficiency, and it is difficult for blockchain to be applied to high-frequency, large-volume transactions, such as processing tens of thousands or hundreds of thousands of transactions per second. Second, the Digital Yuan is a liability of the central bank, and the central bank must take its own liabilities seriously and manage them strictly. For example, cash is also a liability of the central bank, and cash management is the central bank wholesaling cash to commercial banks, and each banknote has a serial number, with the People's Bank having a ledger management for all these banknotes.

Blockchain and distributed architecture mean decentralization, such as Bitcoin, which is based on blockchain and distributed architecture, and has had a significant impact on subsequent digital currencies. Now, some central banks' digital currencies also use distributed architecture. In fact, many central banks' digital currencies focus on wholesale rather than retail business, one important reason being limited by the architecture of blockchain. Blockchain architecture is difficult to effectively cope with the volume and peak business impact of retail business, such as in the "Double Eleven" scenario, with transactions of hundreds of thousands or even more per second.

But it should be pointed out that the Digital Yuan's adoption of the central bank's centralized management does not mean that the central bank will hold all transaction information and personal information. In fact, most of the information exists with various financial service providers. The central bank only holds some important information, such as the situation of large wholesale transactions, the balance of retail accounts, etc., but the specific details of retail transactions, their information is in the systems of service providers like the Industrial and Commercial Bank of China, Alipay, etc., that is, only important information is centralized and concentrated at the central bank.

The dual-layer operation structure is conducive to giving full play to the role of the market. We adhere to the market-oriented direction and have an open attitude towards all possible technical routes. The staff of non-governmental institutions are creative and enthusiastic, and the quality of service is relatively high. For all technical routes and service forms, such as the form of wallets, the way of service, settlement, collateral, guarantee arrangements, etc., they can provide good suggestions. We respect the creativity of the market in these aspects and do not specify that a certain specific technical route must be followed, but establish a unified standard, follow certain principles, and maintain a legal framework at the bottom line. Market institutions can fully exert their creativity within this framework to serve the people.

In addition, the market is also richer in business resources, human resources, and technical resources. For example, many of the students present will possibly work in non-governmental institutions in the future. Knowing that you are students from prestigious schools, we highly respect the human resources and other resources of non-governmental institutions. Therefore, we maintain an open attitude towards technical routes to achieve the optimal allocation of resources, which also actually disperses risks.

2.6 Minimal and Controllable Impact on Monetary Policy

The dual-layer operation system has minimal impact on monetary policy because it essentially does not change the existing financial market structure and the transmission mechanism of monetary policy. Here, I will talk about another concept, also a hot concept in both international and domestic digital currency research, namely 狭义银行 narrow banking. Narrow banking refers to a banking system where 100% of the reserves are held at the central bank. Currently, our banks' statutory deposit reserve ratio averages around 7%, and if this ratio were raised to 100%, it would be narrow banking. The concept of narrow banking has been proposed for many years, and it has been discussed continuously, but are there narrow banks in the world? In fact, our payment institution's reserve fund management is a successful case of narrow banking. As we know, Tencent, Alipay, and over a hundred other third-party payment institutions have accumulated a lot of funds in their accounts, which are the balances of enterprise and resident customers in their wallets, belonging to the customers but held in the accounts of the payment institutions. The People's Bank requires payment institutions to hold 100% of the customers' money at the central bank, which is a practice of the theory of narrow banking.

How is this narrow banking specifically implemented? In 2016, the People's Bank of China consulted the State Council, clarified the management direction, and since July 2018, required payment institutions to hold 50% of their reserve funds at the central bank, gradually increasing the ratio thereafter, and by early 2019, finally raising it to 100%. Now, the balance in the WeChat and Alipay wallets of everyone present is held at the central bank, totaling about 2 trillion yuan. Requiring payment institutions to hold 100% of the customers' money at the central bank helps to standardize market competition and is more conducive to protecting the financial security of the people. We have also heard of cases where third-party payment institutions went bankrupt, but if a third-party payment institution goes bankrupt, the balance in the people's wallets does not suffer losses. Overall, the management of payment institutions' reserve funds is a successful case of narrow banking.

A common concern is that under the framework of narrow banking, all money is stored at the central bank, commercial banks cannot create money, and the money multiplier drops to 1. But in the aforementioned case, the situation in China is not like this. As we know, the money multiplier is the multiple of the total money supply relative to the monetary base, where the monetary base equals the cash in circulation plus the reserves of banks at the central bank. Currently, cash in China is about eleven to twelve trillion yuan, and reserves are about twenty trillion yuan, adding up to about thirty-five trillion yuan of monetary base. Two trillion yuan of payment institutions' reserve funds only account for 6% of the thirty-five trillion yuan base money, and even less of the nearly 290 trillion yuan of broad money M2.

Now, with nearly 290 trillion yuan of M2 compared to more than thirty-five trillion yuan of monetary base, our current money multiplier is still about eight times. This is because our requirement for the banking system's statutory deposit reserve ratio averages around 7%, and the scale of bank deposits far exceeds the scale of payment institutions' reserve funds. Even if payment institutions are required to hold a 100% reserve ratio, it has not significantly affected China's money multiplier and monetary supply structure.

In the design process of the Digital Yuan, we also paid special attention to preventing the occurrence of 金融脱媒 financial disintermediation. Financial disintermediation refers to people converting all their deposits in banks into digital currency, rendering the financial intermediary function of banks ineffective. Since the Digital Yuan is a liability of the central bank, somewhat safer than bank deposits, is it possible that when promoting the Digital Yuan, people will convert all their bank deposits into Digital Yuan, becoming deposits at the central bank? This is a problem that central banks in various countries are seriously considering.

We have fully considered this issue and made corresponding arrangements. The first is to implement a dual-layer operation structure, not changing the existing financial service structure, keeping the service model for the people unchanged, allowing various financial institutions to compete fully to provide better services to the people, rather than letting the central bank do everything.

At the same time, we have also set some rules for the Digital Yuan wallets, to further prevent people from transferring all their money to the central bank. For example, imposing limits on transaction amounts, and the Digital Yuan can be loosely coupled with bank accounts, interoperable with bank account deposits, automatically replenished when used, and deposits can be automatically withdrawn when the balance is insufficient during payment. Another important aspect is that the Digital Yuan does not pay interest, just like cash, meaning that holding the Digital Yuan cannot earn interest like holding bank deposits. These measures help prevent financial disintermediation.

Additionally, when talking about financial disintermediation, we cannot ignore deposit insurance. As we know, according to our deposit insurance regulations, if a bank goes bankrupt, the maximum compensation limit for depositors is 500,000 yuan, but in practice, the level of protection for people's deposits is far higher than 500,000. If we say the safety level of the central bank's cash is 99.9%, not saying 100% mainly because of some anti-counterfeiting considerations. Then, arrangements such as deposit insurance can make the reliability of people's deposits in banks nearly as high as that of cash, which is also very reliable. This is also an important aspect of preventing financial disintermediation.

2.7 Theoretical Summary

The Digital Yuan is a digital form of legal tender issued by the People's Bank of China, operated by designated operating institutions, based on a broad account system, supporting the loosely coupled function with bank accounts, exchangeable with physical yuan at a 1:1 ratio, forming part of the legal currency system together, possessing value characteristics and legal tender, supporting managable anonymity.

3. Pilot Programs and Applications of the Digital Yuan

3.1 Pilot Situation

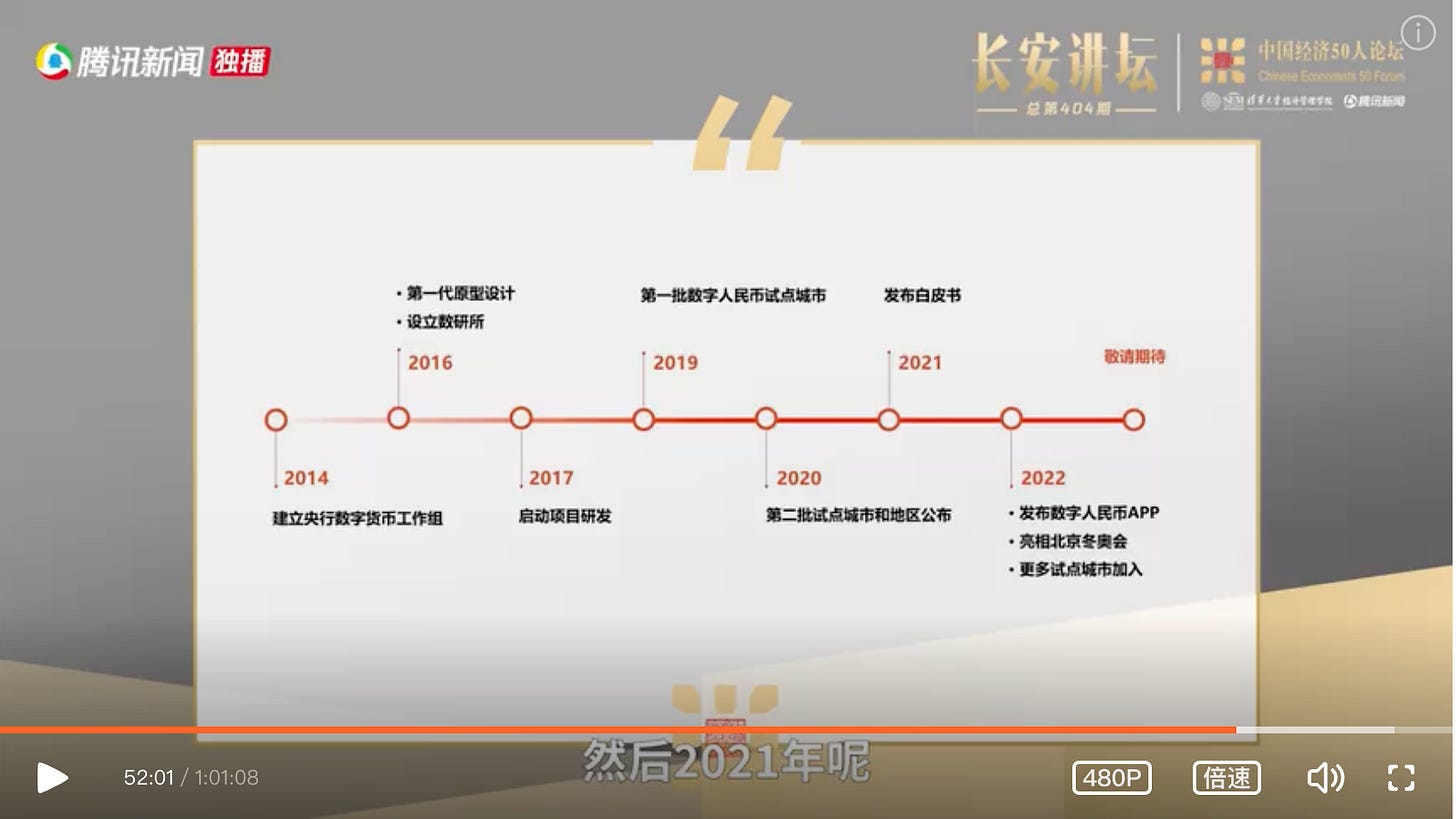

Here, let me briefly introduce the pilot situation of the Digital Yuan. The People's Bank of China started developing the Digital Yuan in 2014, started the first batch of pilot programs in 2019, conducted the second batch of pilot programs in 2020, published the white paper in 2021, released the Digital Yuan APP in 2022, made its debut at the Beijing Winter Olympics, and arranged for more cities to join the pilot programs. Currently, the Digital Yuan has been piloted in many places across the country, with a relatively large overall pilot scope.

Currently, the balance in Digital Yuan wallets is 16.5 billion yuan, supporting nearly 2 trillion yuan in transaction volume and nearly 1 billion transactions, with 120 million individual wallets. Although the balance of the Digital Yuan compared to the total currency volume is very small (less than 80 yuan in a personal account and less than 2,600 yuan in a corporate account), the transaction volume it supports is quite considerable, with relatively high circulation efficiency.

3.2 Extended Products and Applications

The Digital Yuan offers a variety of wallets for everyone to choose from. First, different levels of wallets are set according to different amounts, each type of wallet having different strengths of customer identity recognition, balancing privacy protection and compliance. In addition, there are soft wallets based on mobile apps and hard wallets similar to stored-value cards, etc. The Digital Yuan also supports wireless or electricity-free payments and can carry smart contracts, meeting diverse financial service needs, playing an important role in serving people (to C), serving enterprises (to B), and serving government departments (to G). The Digital Yuan also strongly supports green and low-carbon lifestyles, with many incentive mechanisms that can use the Digital Yuan to support green and low-carbon transformation.

3.3 Cross-Border Use and Cooperation

Cross-border use is another focus area of digital currency research and practice. The Digital Yuan, in terms of cross-border use, also follows the three internationally accepted principles: no harm, compliance, and interoperability.

In cross-border cooperation, we respect the currency sovereignty and monetary policy independence of other central banks, strictly adhere to the laws and foreign exchange management and other relevant regulations of the relevant countries, and avoid currency substitution situations.

For cross-border cooperation, we have developed a product called the currency bridge with several other central banks. The framework has basically been realized by now, and through the currency bridge, digital currencies of participating central banks can be used for cross-border payments, and this payment can be faster and at a lower cost.

The currency bridge has four characteristics: modularity, scalability, balance, and interoperability. What do these characteristics mean in practice? Each country and region has different legislation and policy regulations, and the needs and priorities of cross-border transactions are also different, such as some focusing more on tourism payments, some more on corporate trade, and some more on overseas remittances, etc. In this situation, we need to respect the choice of each central bank, which requires modularity, designing different modules for each function, and incorporating the modules needed by each central bank while temporarily not using the modules that are not needed. Therefore, modularity can be expanded, and it also has good balance, which is more conducive to interconnection and interoperability. For example, we now have management modules, regulatory modules, issuance modules, foreign exchange modules, settlement modules, redemption modules, payment modules, etc., meeting various different business needs.

The governance structure of the currency bridge is the steering committee, with several sub-committees underneath, such as the People's Bank of China leading the technical sub-committee, the Bank of Thailand leading the policy sub-committee, the Hong Kong Monetary Authority leading the legal sub-committee, and the Central Bank of the UAE leading the business sub-committee, with other central banks also participating in various sub-committees.

Different from the domestic institutional arrangement of the Digital Yuan, the currency bridge project is based on distributed and blockchain architecture. Each participating region's central bank can approve the banks under its jurisdiction to participate in the currency bridge, and as long as they follow the relevant rules, they can join the blockchain system of the currency bridge, making the transfer and payment of digital currency between various commercial institutions more convenient.

In addition to the currency bridge, there is also bilateral cross-border cooperation between the Chinese mainland and Hong Kong. The People's Bank of China and the Hong Kong Monetary Authority now have a distributed ledger technology (DLT) system, which realizes cross-border payment of digital currency between mainland banks (such as Bank of China) and Hong Kong banks (such as Standard Chartered Bank). For example, when a mainland customer wants to pay a Hong Kong customer with Digital Yuan, after the Digital Yuan arrives at Standard Chartered Bank from Bank of China, it can be converted into digital Hong Kong dollars, or it can be kept in the Digital Yuan account at Standard Chartered Bank, and the related operation can be completed in less than a second, which is very fast and convenient.

Fmr Central Bank Governor Zhou on Digital Currency & Electronic Payment (DC/EP)

Zhou Xiaochuan, the former governor of the People’s Bank of China from 2002 to 2018, gave a detailed speech on China’s DC/EP (Digital Currency Electronic Payment) on Saturday, May 22, at the 2021 Tsinghua PBCSF Global Finance Forum. Bloomberg, Global Times

Central bank reports progress on digital yuan/RMB

Update after publication: Upon the feedback from a reader, the first sentence in the second paragraph has been amended from The report does not mention a possible role of digital RMB in the internationalization of the Chinese currency to The report does not mention an