Huawei was driven out of China by European rivals, contrary to Desmond Shum's Congressional testimony

As EU plans mandatory ban against Huawei, Ericsson and Nokia are still selling to Chinese core networks.

In a Twitter video paid-promoted by the Voice of America that has been watched more than 1.1 million times, Desmond Shum told the House Select Committee on the Chinese Communist Party (CCP) in the U.S. Congress on July 13

In 1997, working for an American private equity firm, I invested in AsiaInfo. AsiaInfo was laying telecom cable network to help build China’s internet. It was subsequently the first NASDAQ-listed China technology company. That was when I first heard of Huawei. Huawei started its meteoric rise because state-owned telecom companies were ordered by the Chinese government to buy from local manufacturers, in exclusion of international telecom equipment providers, despite cost and technology deficiencies.

Asiainfo went public on Nasdaq in March 2000, so Shum was looking back at events over two decades ago. The video received thousands of likes, retweets, and comments, with zero dispute - despite his description of the circumstances involving Huawei was demonstrably false.

That year, according to Frost&Sullivan, a consultancy, Nokia (18.6%), Ericsson(26.8%), Motorola(20.4%), and Siemens(13.5%) held a bigger market share respectively than Huawei (8.8%) in mobile network equipment.

The annual delivery value of network infrastructure equipment such as GSM mobile switching systems, base stations, and base station controllers reached 47.42 billion RMB. Among them, the delivery value from non-foreign-funded equipment manufacturers was 4.15 billion RMB, and the delivery value of CDMA network infrastructure equipment was approximately 1.5 billion RMB.

At the beginning of the 21st century, the world was still in the era of 2G. In China, the dominant technology in China was GSM (Global System for Mobile communication) and the dominant mobile operator was state-run China Mobile, to which Huawei struggled to sell its equipment.

Zhang Lihua, a former Huawei employee, recounted, in the 2009 book 华为研发 Research and Development of Huawei (now available in its 3rd edition), Huawei’s repeated losses against Nokia, Ericsson, and Motorola.

As of November 1997, Huawei had invested in the field of mobile communication with over 240 research experts, including Ph.D. holders, Master’s degree holders, and senior engineers, which expanded to 500 in 1998. By the end of 1997, Huawei had accumulated over 70 million yuan in research and development expenses for the GSM system, with even more investment reaching hundreds of millions in 1998. In 1998, Huawei's first experimental GSM station was established in Inner Mongolia Autonomous Region, with nearly a hundred on-site debugging personnel. To ensure success, Huawei even arranged for personnel to take two airplanes, leaving no room for error.

At that time, radio frequency talents were few and far between nationwide, so Huawei attached great importance to such personnel. Huawei's substantial investment in GSM market research and development was based on the rapid development of the Chinese mobile communication market. In 1997, China's largest operator, China Mobile, achieved tremendous success with the GSM equipment it adopted in the Chinese communication market. GSM users accounted for 42.5% of the total number of mobile users in China. By 2000, the total number of China Mobile users reached 35 million, with the majority being new GSM users. The dominant position of GSM in China was unshakable.

In China Mobile's GSM market, foreign companies such as Ericsson, Motorola, and Nokia, having learned from their failures in the fixed-line exchange market, quickly initiated price wars when Huawei was about to launch its GSM products in 1998. This move neutralized Huawei's pricing advantage and halted its offensive. The intense price competition in the mobile communication network market, approaching cost prices from the beginning, made Huawei's newly launched GSM products lose their pricing advantage in the market. Moreover, due to China Mobile's cost considerations, by 2003, Huawei's GSM systems had only marginal applications in remote areas such as border networks, rural regions, and Inner Mongolia, and had not entered China Mobile's mainstream GSM market.

In addition to the tough competition in the Chinese market, Huawei's wireless product line suffered losses for about ten years due to the substantial investments made in 3G technology, totaling over 4 billion yuan. Although China's mobile communication market seemed to offer great development opportunities with an annual purchase amount of up to 60 billion yuan, the larger the development opportunities, the fiercer the competition and the greater the risks. In fact, Huawei had been excluded from the GSM main equipment procurement feast for the past decade, and the word "failure" became a common mindset for both the R&D and marketing teams of Huawei's GSM product line.

Huawei’s international rivals had a feast in the Chinese mobile telecom market. China Daily reported in December 2006 “Currently Ericsson is the largest vendor of the 2G (second-generation) mobile telecom gear market in China. The firm is the largest supplier of GSM/GPRS network equipment to China Mobile, with over 35 percent market share. And it accounts for about 15 percent of China Unicom's GSM network.”

In December 2007, Carl-Henric Svanberg, then CEO of Ericsson, told state-run 中国电子报 China Electronics Newspaper that

对未来,我们是充满信心的。我们预期到年底会有10%的增长,这样的话,我们会继续保持35%的市场份额

We are confident about the future. We anticipate a 10% growth by the end of the year, which will allow us to maintain a 35% market share

That was corroborated in a Fortune interview eight months later with Mats H. Olsson, Ericsson’s then head of China, who described the Swedish company as

有13亿人口的国家拥有35%的GSM市场份额

having 35% share of China’s GSM market

While losing the domestic battle over GSM, Huawei had made another mistake in not betting on the CDMA (Code-Division Multiple Access) technology adopted by China Unicom or PHS (Personal Handy-phone System) technology adopted by China Telecom, as Zhang recalled

At that time, Huawei naively believed that CDMA would not achieve widespread adoption in China, particularly due to the technological monopoly held by Qualcomm in all high-end CDMA technologies. [Huawei believed] From a geopolitical perspective, the country was unlikely to adopt CDMA due to China-US relations.

Consequently, between 1996 and 2000, Huawei only allocated a small team for exploratory research on CDMA and did not commit resources to product development. Around 2000, Huawei established a "cutting-edge" CDMA development team at Shenzhen Shiyantou Lake. This team brought together young talents from prominent institutions, led directly by Chen Zhaohui, who was in charge of the wireless business division at that time.

Over the course of four to five weeks, much like the popular saying "Sleepless Nights in Silicon Valley," project summary meetings often began around 2 AM, followed by task planning and deployment for the next day, until it was nearly dawn. Eventually, the brilliant minds successfully overcame the technical challenges within the designated timeframe of less than two months, and they developed Huawei's first CDMA prototype system. However, to the disappointment of everyone, Ren Zhengfei had misjudged the situation. To prevent excessive resource dispersion, he ordered the discontinuation of commercial development. Thus, Huawei's first CDMA product met an untimely demise.

As for PHS, a technology from Japan that was considered outdated, Huawei did not regard it seriously and abandoned it early on.

The early winner of the CDMA market was Lucent, according to state-run media outlet 中国计算机报 Chinese Computer

In May 2001, during the first phase of China Unicom's CDMA network construction project, Lucent achieved tremendous success by securing equipment orders worth hundreds of millions of U.S. dollars. It stood as the foremost among all the winning bidders. The project undertaken by Lucent covered over four million users in 43 cities across ten provinces and autonomous regions, spanning from north to south, including Inner Mongolia, Liaoning, Shandong, Shaanxi, Shanghai, Anhui, Hubei, Zhejiang, Hunan, and Guangdong…Lucent truly lived up to its reputation and emerged as the ultimate victor in the China Unicom CDMA project, and indeed the largest winner in the domestic CDMA market up until 2001.

In 2006, Huawei founder Ren Zhengfei recounted, in Huawei’s publicly available internal newspaper, how the company had to venture overseas because it couldn’t beat international competitors at home

中国是世界上最大的新兴市场,因此,世界巨头都云集中国,公司创立之初,就在自己家门口碰到了全球最激烈的竞争,我们不得不在市场的狭缝中求生存;当我们走出国门拓展国际市场时,放眼一望,所能看得到的良田沃土,早已被西方公司抢占一空,只有在那些偏远、动乱、自然环境恶劣的地区,他们动作稍慢,投入稍小,我们才有一线机会。为了抓住这最后的机会,1996年开始,众多华为员工离别故土,远离亲情,奔赴海外,无论是在疾病肆虐的非洲,还是在硝烟未散的伊拉克,或者海啸灾后的印尼,以及地震后的阿尔及利亚……

China is the world's largest emerging market. As a result, global giants have gathered in China. When our company was founded, we encountered fierce global competition right at our doorstep, forcing us to struggle for survival in the narrow cracks of the market. As we ventured abroad to expand into the international market, we found that the fertile land was already occupied by Western companies. Only in remote, turbulent, and environmentally harsh areas did they move slower and invest less, leaving us with a slim chance. In order to seize this last opportunity, many Huawei employees bid farewell to their homeland, leaving behind their loved ones and heading overseas. Whether it was in disease-stricken Africa, the still-smoldering Iraq, the post-tsunami Indonesia, or the earthquake-ravaged Algeria...

经过十年来的不懈奋斗和挣扎,华为逐渐地在海外取得了一些收获,2005年海外的收入超过了国内,尽管也进入了部分发达运营商的市场,但是我们在超过一半的市场空间里基本上是没有突破,尤其在北美、西欧和日本。

After ten years of unremitting efforts and struggles, Huawei has gradually achieved some success overseas. In 2005, our overseas revenue surpassed domestic revenue. Although we have entered some markets of developed operators, we have not made significant breakthroughs in over half of the market space, especially in North America, Western Europe, and Japan.

While Huawei was implementing, unwillingly, the de facto strategy of “encircling China from overseas,” a Wall Street Journal report in 2004 said

The emergence of China's telecom leader, Huawei Technologies Co., and others as global companies underscores the growing sophistication of the Chinese market, providing even more opportunities for big vendors from around the world.

Between 2005 and 2016, over half of Huawei’s revenue came from outside China. (Huawei, an employee-held company with no public disclosure obligations, publishes reports annually on its website since 2006.)

2017, the year when Donald J. Trump was sworn in office, was the first time in a long time that Huawei made more money (50.5%) from China than from abroad.

Desmond Shum was actually not alone in making erroneous claims that China was “in exclusion of international telecom equipment providers, despite cost and technology deficiencies.”

Hal Brands, an American historian and international relations scholar, wrote in his Bloomberg column in 2021, “Unlike its foreign competitors, Huawei had unfettered access to China’s vast domestic market.”

Norbert Roettgen, Chair of the German Bundestag’s Committee on Foreign Affairs, said in a 2020 interview “Beijing wouldn’t even consider opening its 5G network to foreign providers.”

Friedrich Merz, leader of the Christian Democratic Union (CDU) of Germany, tweeted in 2020 that “In the Huawei debate it was lost that no European telecommunications company has market access in China.”

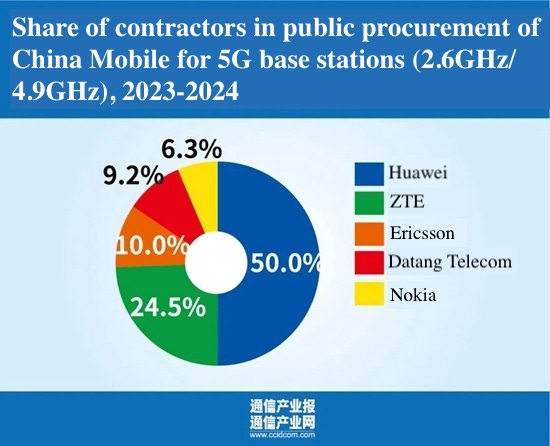

The fact is as late as June 2023 Ericsson and Nokia still won contracts selling 5G stations to China Mobile. They captured 16% of the public bidding.

For Ericsson, China was the 3rd largest country market in 2020 and 2021 after the U.S. and Japan.

China was Ericsson’s 2nd largest country market in 2018 and 2019, after the U.S.

In the years between 2020 and 2022, Nokia’s revenue from Greater China was about 1.5 billion euros annually and actually increased.

That is after the EU, in 2020, adopted the so-called “5G cybersecurity toolbox,” which practically signaled that Huawei and ZTE are somehow risky and encouraged member states to ban the Chinese vendors.

In June this year, in an escalation, the European Union reportedly began considering a mandatory ban on using Huawei in building 5G, after most EU member states resisted previous advice from Brussels to ban the Chinese telecom equipment vendor

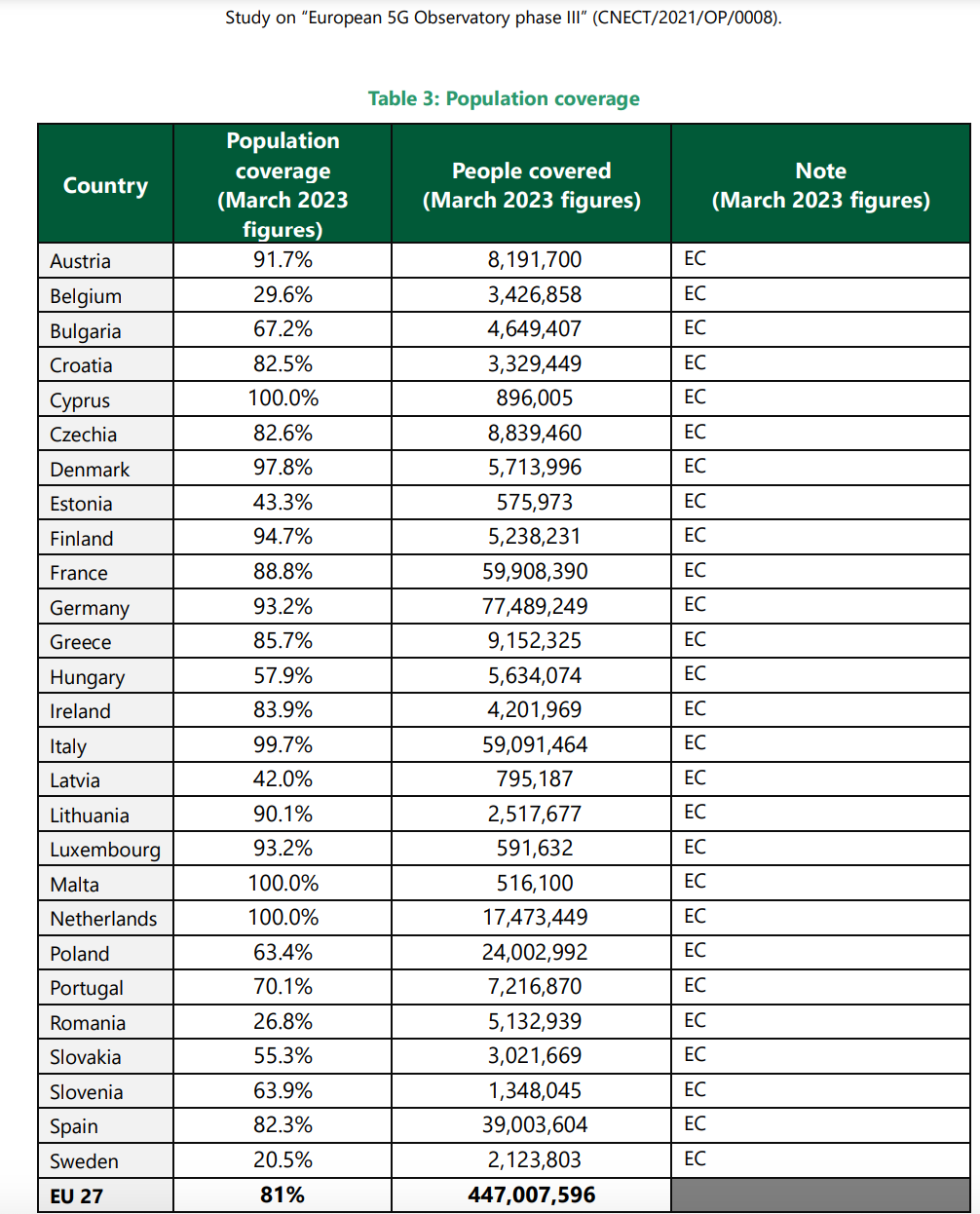

As it happens, the five countries - Estonia, Latvia, Belgium, Romania, and Sweden - that have the lowest 5G coverage of their population are those that excluded or severely restricted Huawei and ZTE, another Chinese supplier, according to the most recent European 5G Observatory Report, which was publicly cited by Vodafone Germany’s head of technology.

“The UK is now falling behind because of limited investment by mobile phone operators and disruption caused by the government’s ban on kit from Huawei, the Chinese telecoms equipment maker,” the Financial Times quoted analysts and industry executives as saying earlier last month.

Also in August, Germany’s Interior Minister Nancy Faeser said “We will prohibit components if they pose a serious security risk,” reported as calling on German telecom operators to remove Huawei and ZTE equipment based on unproven “security risks” despite admitting they are more cost-effective. (Sweden, Ericsson’s homeland, banned Huawei equipment in 2020 and ordered all Huawei equipment removed by 2025.)

A discussion of reciprocity here is a rabbit hole, as that would have to incorporate state intervention in the first place, rather than let the market players sort it out on their own. However, too often missing in Western coverage and discussions is that China doesn’t appear to have similar concerns for Nokia or Ericsson, and the EU’s thinly veiled discrimination against Huawei since 2020 hasn’t changed Beijing’s attitude - the European vendors are still selling to the core parts of the Chinese telecoms network run by China’s state mobile operators. An interesting anecdote is that Huawei opened its source code to international inspection at its transparency centers, but Ericsson and Nokia are still resisting the approach.

Read Pekingnology’s archive on Huawei’s Ren Zhengfei

How Ren Zhengfei grew up, in the Huawei founder's own writing

How Ren Zhengfei grew up, in the Huawei founder's own writing

“If there’s a Darth Vader in the minds of Chinese national security hawks in Washington worried about China’s rising tech power, it’s Ren (Zhengfei).” said a Bloomberg story in 2018, conveying the enormous Western doubts and concerns in the founder of Huawei.

Huawei's rotating chairman described founder Ren Zhengfei as "most pro-U.S."

Huawei's rotating chairman described founder Ren Zhengfei as "most pro-U.S."

We’ve had this in our draft box for quite some time but Irene Zhao at Jordan Schneider’s brilliant ChinaTalk had just beat us to it so…I have rushed to publish it. Ren Zhengfei, the founder of Huawei, gave a speech and answered questions at a symposium organized by Huawei at Shanghai Jiao Tong University, a top Chinese university. The Feb 24, 2023, sympo…

Ren Zhengfei's trip to the U.S. almost three decades ago

Ren Zhengfei's trip to the U.S. almost three decades ago

The last Pekingnology newsletter, a translation of Ren Zhengfei’s My Father and Mother written in 2001, was apparently well-received, as the autobiography unveiled many personal details from the Huawei founder.

Mr. Ren Zhengfei went to Moscow

Mr. Ren Zhengfei went to Moscow

IL-86 In July, Pekingnology translated Huawei founder Ren Zhengfei’s mini-autobiography which details his upbringing, and his notes from visiting the United States in 1994. This newsletter translates his article published in 1996, where he wrote extensively about “the first time for Huawei to participate and compete in such a large-scale international e…

Huawei founder's observation of Japan's "lost decade"

Huawei founder's observation of Japan's "lost decade"

“If there’s a Darth Vader in the minds of Chinese national security hawks in Washington worried about China’s rising tech power, it’s Ren (Zhengfei).” said a Bloomberg story in 2018, conveying the enormous Western doubts and concerns in the founder of Huawei.

Huawei founder's farewell remarks to Honor

Huawei founder's farewell remarks to Honor

Huawei is in the news but this isn’t about CFO Meng Wanzhou’s homecoming :) The Washington Post last week reported key security agencies are divided over whether to place Huawei’s former smartphone company on an export blacklist, after a group of 14 Republican lawmakers in the U.S. House of Representatives asked the Commerce Department to add Honor to th…

This reads like a subtle propaganda on behalf of Huawei/CCP.